Senators have called for an investigation into the controversial Sh38 billion medical equipment leasing project, for which each of the 47 counties repays Sh200 million annually.

With three years remaining to the end of the seven-year lease - and over Sh25 billion already appropriated - the Senate has questioned whether the financing model was the best and whether Kenyans are getting value for their money.

The senators argued that the annual Sh200 million payment was steep considering that many health facilities remained in a deplorable state, while others did not have the amenities to store the equipment.

These concerns emerged following the allocation of Sh9.4 billion for the project in the 2018/19 national government budget.

The Senate Finance, Budget and Trade committee questioned the increase of funds from the initial Sh4.5 billion each year in 2015 to Sh9.4 billion without a proper account on the successes or failures of the programme.

Create loopholes

The House team cautioned that lack of a policy framework to guide management of conditional grants created loopholes for misuse of such funds.

“This is a scandal in the making. As senators we have no idea what purpose some of those conditional grants in the Budget are supposed to be used for. We should not be asked to approve what we don’t know anything about,” said Makueni Senator Mutula Kilonzo Jr.

He added: “Why should Makueni County be paying Sh200 million yearly yet health facilities have not improved? Why should we lease when we can buy?”

The committee recommended an audit of the medical equipment leasing programme to establish why there has been a tremendous increase of funds allocation by the National Treasury over the years, without any paperwork to show how the funds were utilised.

“We must interrogate the contracts signed between the national government and suppliers of the equipment, on one hand, and those signed between the former and the Council of Governors a bid to scrutinise how the billions allocated to counties over the years have been used,” Mutula said.

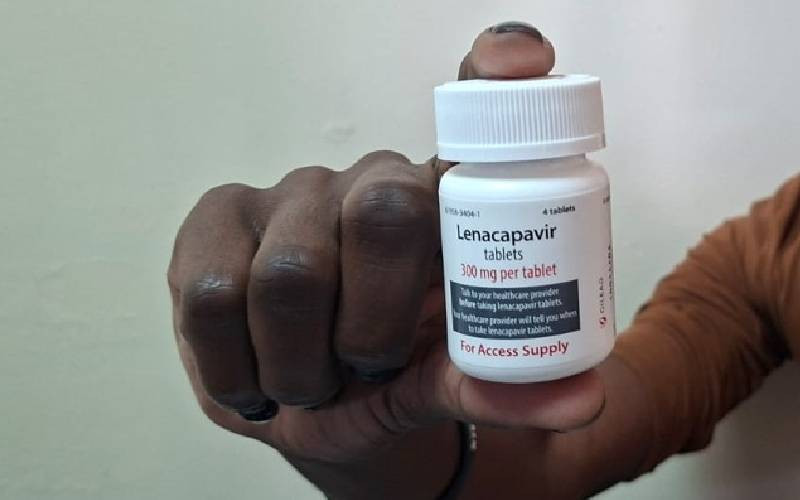

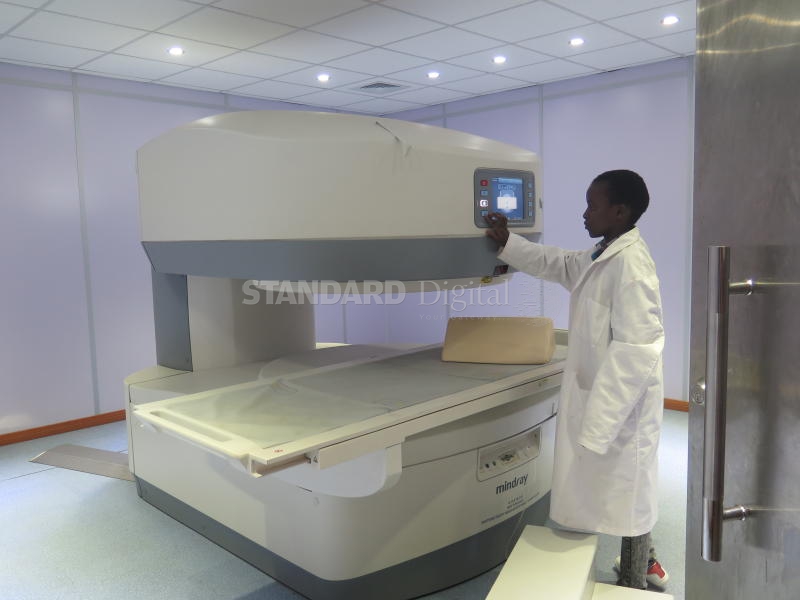

Governors had initially resisted signing the project in 2015, claiming that they did not fully understand how the deal was structured. Then Treasury Cabinet Secretary Henry Rotich said that two hospitals from each of the 47 counties would each receive state-of-the-art ultrasound and x-ray machines, intensive care unit tools, dialysis kits and theatre equipment.

Cancer and diabetes

The leasing deal is aimed at enabling counties improve their capacity to address diseases such as cancer, diabetes, renal conditions and maternal complications.

Five international companies won the leasing tender. They included General Electric (GE) from the USA, Philips from the Netherlands, Bellco SRL from Italy, Esteem from India and Mindray Biomedical of China.

They earn leasing fees of more than Sh5 billion annually over seven years.

Mutula urged the National Treasury and Commission on Revenue Allocation (CRA) to come up with a policy framework on how conditional grants are being managed.

Senator Ledama ole Kina (Narok) alleged Parliament was being used as a rubber stamp by the Executive and stressed that there should be value for money.

“The people of Narok should be engaged to say whether they want to lease the equipment or not. It is sad we are still leasing equipment in this era. We should not burden the taxpayers.”

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national

and international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national

and international interest.