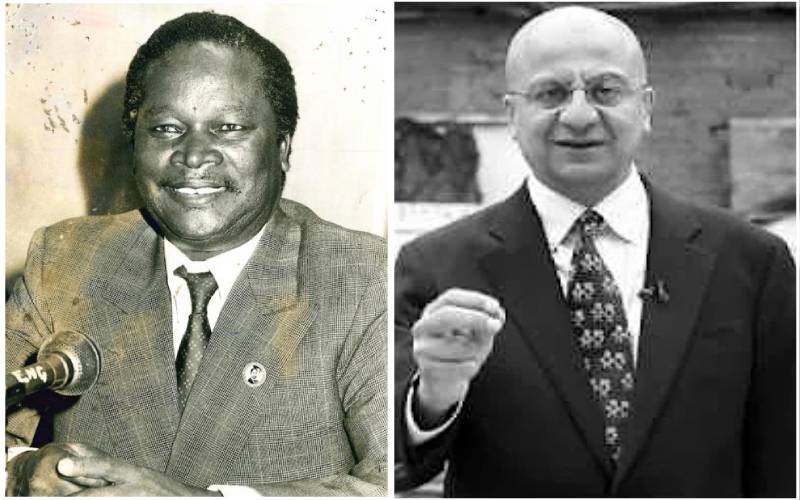

Former Cabinet Minister Nicolas Biwott and Alnoor Kassam. [Courtesy]

In his early thirties, Alnoor Kassam had already built a multi-million financial empire. What was lacking was a bank.

One of his multiple businesses was as the local franchise holder of the Diners Club International, the then biggest credit firm in the country.

Facts First

Unlock bold, fearless reporting, exclusive stories, investigations, and in-depth analysis with The Standard INSiDER subscription.

Already have an account? Login

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national

and international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national

and international interest.