|

|

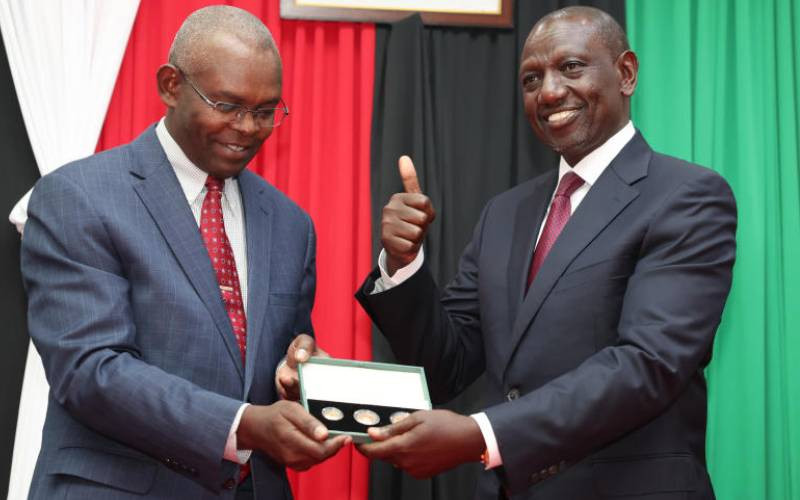

CBK Governor Njuguna Ndung’u. |

The Central Bank of Kenya (CBK) Monday announced that it will publish lending rates across all commercial banks.

This latest initiative is designed to provide information on what each bank is loading above the benchmark of the Kenya Banks’ Reference Rate (KBRR), a tool that became effective in July this year.

While the KBRR remains at 9.13, most commercial banks have their lending rates at more than twice that rate, at levels that have locked out most potential borrowers from the formal credit market.

CBK Governor Njuguna Ndung’u reckons that there are customers who withhold crucial information when making a loan application, which exposes the lender to adverse selection.

“This is why we are creating a credit sharing information platform that will allow banks to price and analyse the risk profile of their borrowers. Eventually, we expect lending rates to also begin coming down,” said Prof Ndung’u.

Strategic plan

He made the remarks Monday while launching a five-year strategic plan of the newly formed Association of Kenya Credit Providers (AKCP), covering 2015-2019.

AKCP is already on a recruitment drive to increase membership with a target of 740 credit providers by the end of 2019.

“This recruitment aims to capture new categories of credit providers such as Saccos, private equity funds, retail credit providers and specialised small and medium enterprises among others,” said Jared Getenga, AKCP Chief Executive.

At the moment, only commercial banks, micro-finance banks and credit bureaus are able to share full file information among themselves on the Credit Information Sharing (CIS) platform. Exploratory discussions are ongoing to include utility companies, telcos, leasing companies and consumer credit firms.

The number of lenders and borrowers accessing credit reports generated by Credit Reference Bureaus (CRBs) is still low due to the negative perception that the bureaus have.

“While CRBs were initially sharing negative information on non-performing loans, the focus has now changed to also include performing loans,” explained Mr Getenga.

The Credit Information Sharing platform provides a 360 degrees view of a borrower, including their credit score, which was introduced in February this year, to add value to credit reports. The CIS mechanism allows those with higher credit scores to negotiate for better loan rates.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.