News that we would soon join the league of oil-exporting countries was received with excitement across the country. And rightly so.

Oil, for decades, has been the black gold that has turned poor countries into wealthy nations.

Most of the Gulf-states would be struggling economically were it not for the petro-dollars that continue to oil their economies.

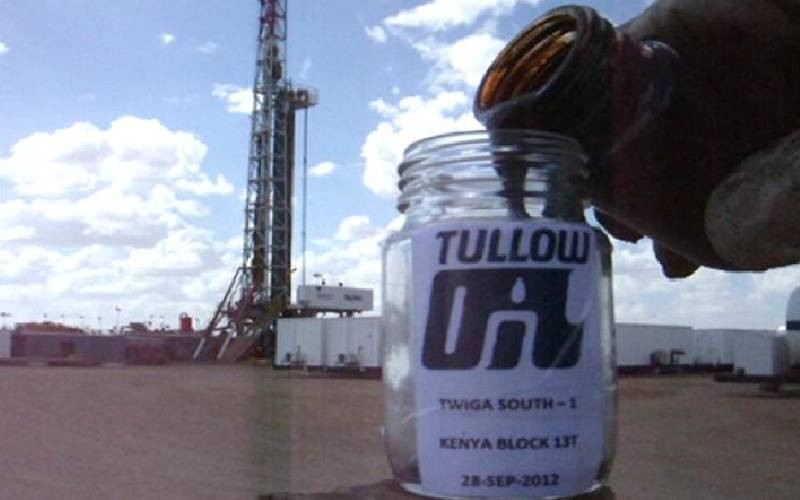

Kenyans understand the value of oil going by the high price they have been paying for the commodity. That is why the announcement in March 2012 that British explorer Tullow Oil Plc had struck oil in Turkana was watershed.

But, sadly, the hope for a windfall that would pave our road to prosperity is crumbling fast. Matters are made worse by the fact that the government has recently been on a borrowing spree, hoping to repay the loans with money that it will harvest from the oil.

Nine years after Kenya first announced it had struck oil, the dream of mega riches appears to be slipping away.

Experts have already cast doubts on the size of our oil reserves, global prices of the commodity remain volatile and the government and Tullow Oil keep on shifting goal posts.

Kenyans want answers, and they want them urgently. While they hope and pray that Tullow’s financial woes are temporary setbacks, they expect answers from the government should things go wrong.

Beside Kenyans investing their hopes in the project, they have also supported the oil exploration activities running into Sh7 billion by paying taxes. They want to know whether this project is still viable. They want to know whether we should still bank on it after the current ongoings.

Notably, Tullow has been shifting goalposts. First, it said the recoverable oil reserve stood at 750 million barrels. But this has since changed to 560 million barrels.

Although the country has earned nearly Sh1.2 billion through the early oil pilot scheme in 204,000 barrels that have so far been trucked to Mombasa, no one knows exactly when commercial production will begin.

The government and Tullow have different timelines. The government thinks it will be in 18 months after a Final Investment Decision (FID) has been made. This, according to the government, is the time it would take to construct a crude pipeline from Lokichar to Lamu. But Tullow says it will take three years to complete the pipeline.

Moreover, while the London Stock Exchange-listed company has been saying that the (FID) was to be made before the end of 2019, this has changed to 2020.

Ultimately, this is a learning curve for the government. While we were so keen to avoid the oil curse that comes with the windfall of the oil finds, we forgot to do some due diligence in managing our expectations by over indulging in our expenses hoping to recover from the oil wealth.

Stay informed. Subscribe to our newsletter

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.