Some 69 per cent of businesses reported a decrease in turnover, on average by 40 per cent compared to pre-pandemic levels in 2019.

The MSME sector in East Africa remains one of the worst hit sectors by the adverse effects of the prolonged COVID-19 pandemic. Deutsche Sparkassenstiftung and its local partner AMFI-K intervene through Credit Rotational Funds.

Kenya’s economic growth in the pre-COVID-19 period was robust and resilient, expanding by 6.3 percent in 2018 and 5.4 percent in 2019. The economy was projected to grow by about 6.2 percent in 2020/21 but Covid-19 led to the contraction of the Kenyan economy by -0.1 percent in 2020.

The instituted containment measures to curb the spread of the virus accelerated the economy's shrinking, forcing the government to deploy both fiscal and monetary policies to cushion its citizens from the adverse effects of the pandemic.

Economic effects of the pandemic hit MSMEs and microfinance institutions alike

While the shock was minimized for citizens through loan repayment reliefs and restructuring of loans, microfinance institutions are yet to recover due to the increase in the number of non-performing loans. This is mainly because many micro, small, and medium enterprises (MSMEs) in Kenya experienced great challenges with business cash flows.

Some 69 per cent of businesses reported a decrease in turnover, on average by 40 per cent compared to pre-pandemic levels in 2019. As a result, small-scale entrepreneurs’ financial vulnerability increased, leading to inability to repay their loans.

Since MSMEs are largely served by microfinance institutions, their liquidity directly affects that of the institutions. This explains why many microfinance institutions continue to face liquidity challenges. The situation has forced them to introduce lending restrictions to avert further lending risks thereby adding to the already existing problems of access to affordable finance for MSMEs and making their situation direr.

Credit Rotation Funds as a bridge for Microfinance Institutions

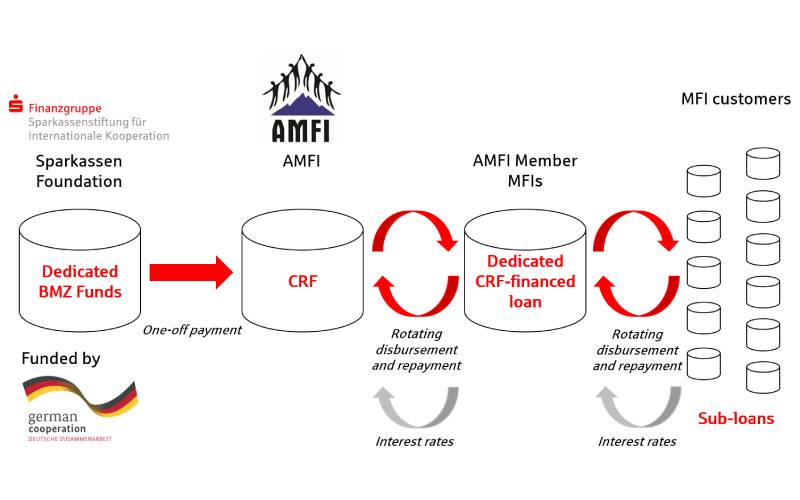

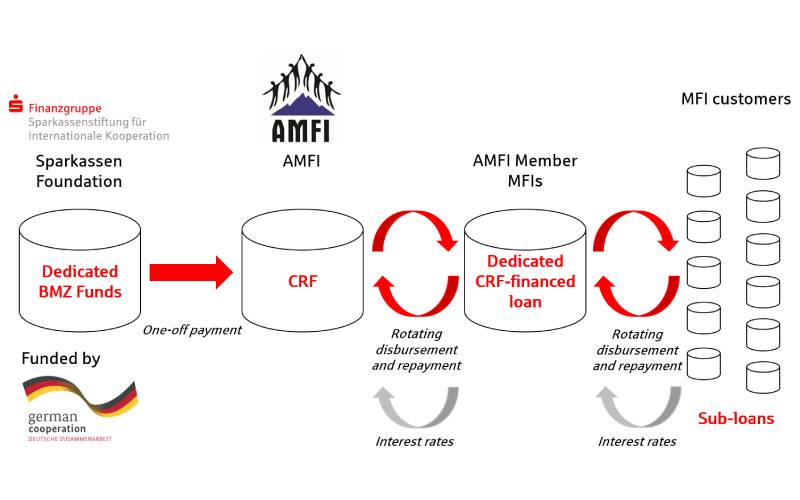

To bridge the gap of access and affordability, the German Sparkassenstiftung Eastern Africa (DSIK) together with its partner the Association of Microfinance Institutions in Kenya (AMFI-K) has set up a Credit Rotational Fund to support the efforts of the Kenyan Government and other stakeholders to mitigate the negative consequences of the COVID-19 pandemic on MSMEs.

“The objective of the Credit Rotation Fund is to provide low-interest loans to financially sound and compliant institutions of the microfinance sector as additional liquidity to meet the demand for loans by clients during and after the COVID–19 pandemic with the aim of mitigating the negative impacts on their businesses,” says AMFI-Kenya CEO Caroline Kabui Karanja. The fund functions as a refinance facility for onforward lending to the MSME sector. Its resources are invested on a revolving basis at the level of the microfinance institutions and at the level of the customers. Successfully repaid loans are re-disbursed and multiply the original fund volume over time, enabling additional clients to be reached.

Successful start in Kenya

The first round of funds provided by the German Federal Ministry of Economic Cooperation and Development (BMZ) under co-management of DSIK and AMFI Kenya was successfully disbursed to two microfinance institutions – Sumac Microfinance Bank and Jitegemea Credit Scheme who are lending to their clients on friendlier loan terms to ensure effective inclusion of MSMEs who are likely to be locked out by financial institutions due to their inability to meet strict lending criteria.

During the signing ceremony at AMFI-Kenya headquarters in Nairobi, Sumac Microfinance Bank CEO John Njihia noted that that the fund will go a long way to assist some of the bank’s MSME and agribusinesses clients who had been adversely affected by the Covid-19 pandemic. “We seek to cushion our clients from the effects of the COVID-19 pandemic in the best way possible, and this fund couldn’t have come at a better time for us,” Mr. Njihia said.

Jitegemea Credit Scheme CEO Laban Hihu Mwangi was all smiles as he put pen to paper. “This Credit Rotation Fund is crucial to the microfinance sector, and we are delighted to be among the first two microfinance institutions to be selected for a share of the fund,” he said.

Eligible microfinance institutions will have the opportunity to repeatedly apply for loans from the fund, to contribute to the support of economic activities in Kenya especially the establishment and development of MSMEs.

On his part, DSIK Country Director Tonny Otieno assured microfinance institutions in Kenya of his full support in this regard, whilst noting that DSIK was absolutely committed to helping businesses in Kenya to get back on their feet.

“We are keen to see businesses emerge from the ruins of Covid-19 pandemic, and that is why we set up this fund in partnership with AMFI-Kenya,” says DSIK Country Director Tonny Otieno. He remains hopeful that the CRF will grow exponentially in order to benefit more microfinance institutions and their clients. Next year, when the fund enters its 2nd round, it is expected to be strengthened through revenue retention and acquisition of further funding from other organizations so that higher loans can be extended to more MFIs. “We hope to attract more partners to contribute to the Credit Rotational Fund in order to have a broader mandate and capacity to help financially strengthen businesses in the country,” he emphasized.

With their structure, revolving credit funds contribute to the sustainable supply of the credit sector. This improves the situation for microfinance institutions and for the people on the ground, an important objective of DSIK.

German Sparkassenstiftung Eastern Africa (DSIK)

German Sparkassenstiftung Eastern Africa (DSIK) is a German based non-governmental organization that implements financial inclusion, and economic empowerment projects in more than 200 countries globally with a focus of professionalizing service delivery especially in micro lending sectors to ensure sustainable financial inclusion. It mainly works with umbrella bodies of microfinance institutions and SACCOs in Eastern Africa to design need specific projects that are implemented through member institutions to reach the end beneficiaries – MSMEs, farmers, women, youth and rural dwellers through financial education, capacity development and economic empowerment programs.

Contacts

German Sparkassenstiftung Eastern Africa

Country Office Kenya

NAS Apartment No. 10

Nass Drive, Off Milimani Road

P.O. Box 44135-00100 Nairobi, Kenya

E-Mail: [email protected]

Office Phone: +254 723 393 122

www.sparkassenstiftung.de

www.sparkassenstiftung-easterafrica.org

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.