×

The Standard e-Paper

Fearless, Trusted News

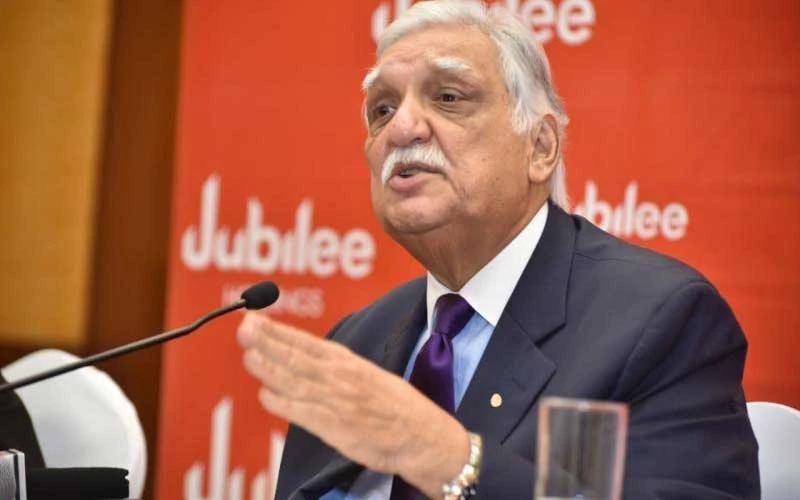

Listed Insurer Jubilee Holdings has reported a 1.7 per cent rise in profit for the year ended December 2020, weathering economic shocks caused by the Covid-19 pandemic.

The firm made Sh4.087 billion after-tax during the year, up from Sh4.017 billion in 2019, attributed to strict control of claims and expenses and a diversified investment portfolio.