×

The Standard e-Paper

Fearless, Trusted News

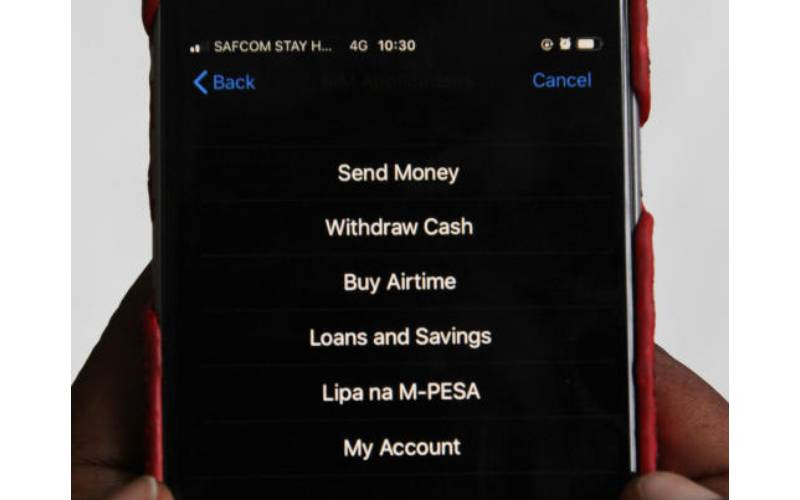

A report on the country's banking sector has detailed the bitter-sweet relationship Kenyans have with mobile money transfer service M-Pesa.

While the service has grown to become a darling among many Kenyans due to its convenience, the report also lists some aspects of the business that Kenyans do not regard highly.