×

The Standard e-Paper

Join Thousands Daily

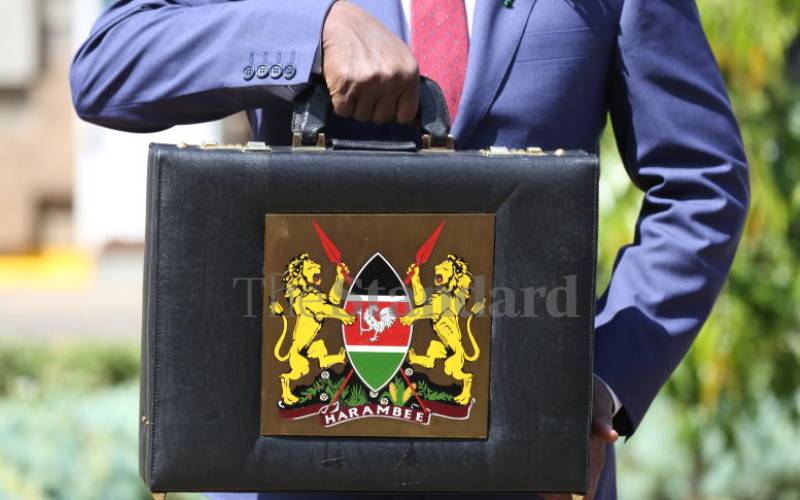

Kenya’s budget will touch a record Sh4.05 trillion for the first time, according to new data released by the National Treasury.

This is when debt redemptions of Sh702.5 billion, which were left out of Treasury Cabinet Secretary Ukur Yatani’s Budget statement on the country’s Sh3.34 trillion spending plan delivered last Thursday, are included in what is President Uhuru Kenyatta’s last Budget ahead of the August 9 polls.