By JAMES ANYANZWA

Central bank is wary of the inflationary pressures emanating from the implementation of the Value Added Tax (VAT) law and the high current account deficit.

The banking sector regulator said the two factors remain potential threats to the macroeconomic stability.

It also noted that continued volatility in international oil prices and the spillover effects of global slowdown could dampen the country’s economic prospects.

According to the Bank’s Monetary Policy Committee (MPC), economic activity in the Eurozone remains weak while instability in the Middle East and North Africa (MENA) could escalate.

Short-term increases

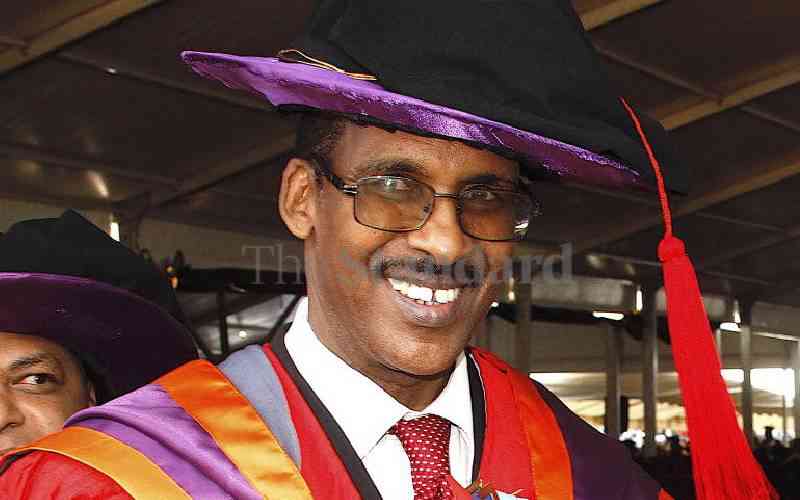

“These developments coupled with the high current account deficit remain a threat to macroeconomic stability,” said Prof Njuguna Ndung’u CBK Governor CBK. Ndung’u who is also the chairman of the advisory committee noted that implementation of the VAT law would contribute to short-term increases in inflation.

“Following the instability in the MENA region, international oil prices rose between June and August 2013 which contributed to the increase in domestic fuel prices,” he said.

Central Bank is also concerned that the country’s foreign exchange inflows from tea exports to the MENA region, which account for about a third of Kenya’s tea exports are likely to be affected. CBK observed that growth in exports has been sluggish with little diversification away from the traditional exports of coffee, tea and horticulture while imports have largely been essential goods whose demand does not respond to price changes.

These include machinery and transport equipment, manufactured goods and oil products for industrial purposes.

According to CBK the huge import bill in the current account increases demand for foreign currency, while slowdown in exports of goods reduces the inflow of foreign currency.

The combined effect exerts pressure on the exchange rate to weaken.

Kenya’s current account balance has generally been in deficit since 2004 when the deficit stood at 0.82 per cent of gross domestic product (GDP).

The deficit widened to stand at about 10 percent of GDP in 2012 largely reflecting a faster growth in imports of goods into the country relative to exports.

According to the Kenya National Bureau of Statistics (KNBS) the country’s current account deficit worsened by 50.6 per cent to Sh95.35 billion during the second quarter (April-June) of this year from Sh63.3 billion in a similar period last year.

Stay informed. Subscribe to our newsletter

The Government expects the economy to grow by six per cent in 2013 up from 4.6 per cent last year driven by growth in sectors such as agriculture.

Tourist arrivals

But economic activities in the country fell during the second quarter of this year owing to a sharp decline in the number of tourist arrivals, slowed growth in wholesale and retail trade and reduced spending by the government.

Data from the KNBS shows the economy expanded by 4.3 per cent during the period running from April to June compared to 4.4 per cent in a similar period last year.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.