×

The Standard e-Paper

Kenya’s Boldest Voice

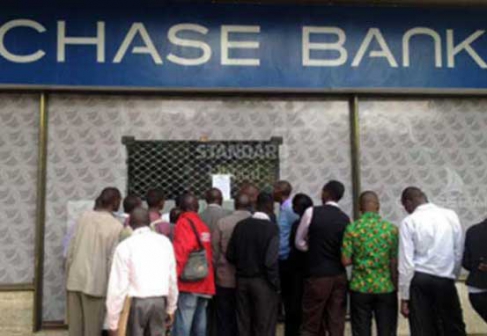

NAIROBI, KENYA: Anxiety is rife among Chase Bank staff ahead of an audit by the State Bank of Mauritius which is set to take over some employees and branches.

Central Bank of Kenya on Monday said it had received the initial offer from SBM setting stage for a due diligence process set for this week.