NAIROBI, KENYA: Anti-corruption crusaders Okiya Omtatah Okoiti and Nyakina Gisebe have moved to court seeking an explanation from the Executive on Eurobond transactions.

The activists are concerned that mystery surrounds funds government borrowed from the international markets which have not been properly accounted for as required by law.

Omtatah and Gisebe argue that those involved in the legal handling of the Eurobond saga must held to account because the law was breached and Kenyans lost money.

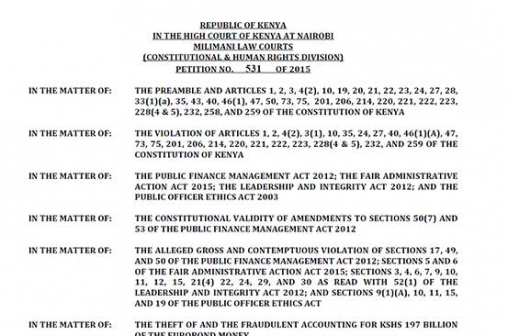

The Petitioners are aggrieved that the Constitution, the Public Finance Management Act 2012, the Fair Administrative Action Act 2015, the Leadership and Integrity Act 2012, and the Public Officer Ethics Act 2003 have all deliberately been violated by the respondents in the handling of the Eurobond proceeds, resulting in the money being used in a way that is not transparent and accountable, and giving rise to the reasonable suspicion that some Sh197 billion of the money was stolen.

Omatata and Gisebe argue that by banking the money in a secret offshore account in violation of the law, the respondents put the Eurobond funds outside the oversight and accountability organs established in law, including Parliament and the Controller of Budget

Below is a summary of the pleadings as well as full petition of their court papers.

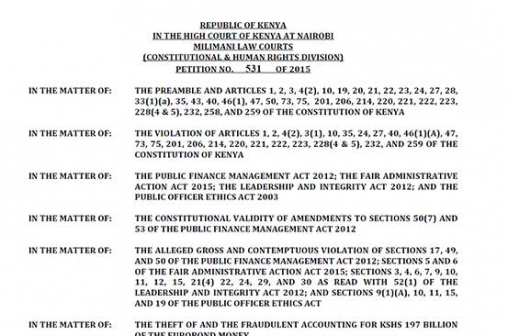

On Monday, 1st December 2015, we filed a Constitutional Petition No. 531 of 2015 at the High Court in Nairobi (Milimani Law Courts) seeking to unravel the mystery surrounding the use of the US$ 2.75 billion (equivalent to some Kshs. 275 billion, using an exchange rate of Kshs. 100 to the US dollar) which was borrowed by the Government using a sovereign bond from international money markets in the period between June – November 2014.

2. The Eurobond was raised and budgeted for in the fiscal year 2014/15. A sum total of some US$ 2.75 billion was raised from the Eurobond:

a. In June 2014, the government borrowed US$ 2 billion through the Eurobond for infrastructure development and to repay a syndicated loan the government owed three international lenders.

b. By December 2014, the government had borrowed a further US$ 750 million from the international market through the Eurobond by way of “Tap Sales” to finance infrastructure projects.

3. The money, which is popularly referred to as the Eurobond proceeds, was, contrary to Article 206(1)(a) and to Sections 17, 49, and 50 of the Public Finance Management Act 2012, deposited in an undisclosed offshore account and not in the Consolidated Fund, and its use has been a closely guarded secret.

4. By banking the money in a secret offshore account, the respondents put the Eurobond funds outside the oversight and accountability organs established in law, including Parliament and the Controller of Budget. The two constitutional organs were effectively locked out from any transactions involving the public funds.

5. Under Article 206(2) of the Constitution, money may be withdrawn from the Consolidated Fund only— (a) in accordance with an appropriation by an Act of Parliament. Under Article 206(3) money shall not be withdrawn unless the withdrawal of the money has been authorised by an Act of Parliament. Under Article 206(4) money shall not be withdrawn from the Consolidated Fund unless the Controller of Budget has approved the withdrawal.

6.The secretive use of the money is violative of Article 10 (2) of the Constitution on the rule of law, democracy and participation of the people, good governance, integrity, transparency and accountability. It is also violative of the obligation placed on the State by Articles 35(3) to publish and publicise any important information affecting the nation, and by Article 232(1)(f) which states that the values and principles of public service include transparency and provision to the public of timely, accurate information. Many statutes impose the same requirements on the government.

Stay informed. Subscribe to our newsletter

7.On 28th October 2015, following reasonable concerns that some of the Eurobond money was missing and may have been stolen, we wrote a letter to various government officials seeking irrefutable evidence backing their statements in the media that the Eurobond money was used to benefit the Kenyan public.

8.Among the information we sought were bank statements for all bank transactions providing evidence that the Central Bank of Kenya actually received the Eurobond; bank statements for all bank transactions providing evidence that the Central Bank actually transferred the Eurobond funds to the various ministries, departments, and agencies of the Government of Kenya; development (not recurrent) budgets of each ministry, department, or agency of the Government of Kenya which received the money; and a breakdown of specific projects which benefitted from the Eurobond money.

9.In the meantime we conducted an audit of the various government accounting documents released to the public by the Treasury and by the Controller of Budget to trace the Eurobond money. Our efforts yielded the following six scenarios:

a.Scenario One: No money is missing/was stolen since all the Eurobond money was spent to benefit the public. In the Press release of 28th October 2015 titled, Statement by the Cabinet Secretary on the Proceeds of the Sovereign Bond, and in the Annual Public Debt Report 2013-2014, published by the Treasury in December 2014 (on page 48 at paragraph 9.4) it is claimed the Eurobond proceeds were used for repayment of the USD 600 million syndicated loan and budgetary support including financing of infrastructure development.

b.Scenario Two: Sh 14,039,733,080.25 is missing and/or was stolen. The Auditor General’s Report for 2013/2014, on the first US$ 2 billion Eurobond funds, points out that US$ 999,052872.97 (equivalent to some Sh 87,767,528,223.47) was not accounted for. In the Budget Implementation Review Report FY 2014/15 – at page Seven Table 3.1, col. 2) on actual receipts to the exchequer for the Period 2014/2015 indicates an amount of Sh 73.81 billion (Equivalent to USD $840, 184,681.41 ) was received in this period. When the figure is deducted from the amount missing in the Auditor General’s audited accounts for financial Year 2013/14 of Sh 87,767,528,223.47 the difference is Sh14,039,733,080.25 (equivalent to US$159,815,318.59).

c. Scenario Three: Kshs 38.5 billion is missing and/or was stolen. On pages 12 – 13, at section 3.4.1 of the National Government Budget Implementation Review Report First Quarter FY 2014/15, it is claimed that the money was used to benefit Kenyans with a Sh38.5 billion balance in Special Account at CBK as of 9/30/2014. This basically means that some Sh38.5 billion of the Eurobond money was missing or had been stolen.

d. Scenario Four:Sh 135 billion Eurobond money is missing and/or was stolen. The Quarterly Economic and Budgetary Review, Fourth Quarter, Financial Year 2014/2015, Period ending 30th June 2015 (QEBR) - the budget outturn on Page 17, Table 9, Row 5, line item 5 shows that the Eurobond target was to borrow Sh141 billion from international lenders to be used during the fiscal year 2014/15. But the budget outturn indicates a zero in the actuals column of the Eurobond line item. Assuming any receipts of the Eurobond money is recorded in the “commercial loans” line item (on Page 18, Table 10, Row 2, line item 5), then the Government received Kshs75 billion for this fiscal year from “commercial loans”. But dividends received by the Government from State corporations are also recorded under this line item. This was approximately Sh13 billion (i.e., Safaricom 6.4 billion, Communications Authority 4.0 billion, Kenya Commercial Bank 1.4 billion, and KenGen 0.92 billion). Shs 75 billion – Shs 13 billion = Shs 62 billion, meaning only some Kshs 62 billion of the Eurobond money could possibly have come in during the fiscal year 2014/15. Page 18, Table 10, Row 3, Line 4 and Page 24, Table 15, Row 36, as read with paragraph 10 on Page 17, show that a sum of Shs 53 billion was used to make principal repayments due to commercial (i.e., syndicated bank) loans. Sh53 billion + Sh62 billion = Shs 115 billion, meaning only some Kshs 115 billion of the Eurobond money could possibly be accounted for during the fiscal year 2014/15. Some Kshs 135 billion Eurobond money is missing and/or was stolen.

e.Scenario Five: Kshs 140 billion Eurobond money is missing and/or was stolen. A review of the QEBR against the Budget Review and Outlook Paper (BROP) dated September 2015 reveals three different accounts of the proceeds of the Eurobond: As per the QEBR, Shs 88 billion and Sh75 billion was spent in FY 2013/14 and FY 2014/15 respectively. This amounts to Sh163 billion leaving Sh76 billion unaccounted for. The BROP provides two different accounts, Table 4 on page 7, and Annex Table 2 on page 34 of the report. Table 4 account shows that Shs. 35 billion was spent in FY 2013/14 and Sh75 billion in 2014/15. This totals Kshs. 110 billion, leaving Sh139 billion or thereabouts unaccounted for. The Annex Table 2 account shows Sh33 billion spent in FY 2013/2014. In 2015, the proceeds appear in two different lines, Kshs. 75 billion as commercial financing and Sh140.5 billion as “Eurobond Proceeds.” This totals Kshs. 251 billion, using an exchange rate of Kshs. 91 to the US dollar. Figures in Annex Table 2 accounts for all Eurobond proceeds by adjusting the domestic financing downwards from Sh251 billion to Sh110.6, the difference being the Sh140.5 billion given as “Eurobond” proceeds. Eurobond proceeds to the tune of Sh140 billion were not used to finance the FY 2014/2015 budget, neither is it reflected as carried over to the FY 2015/2016.

f. Scenario Six: Sh197 billion shillings is missing/was stolen. The only money one can be sure was spent as stated is the Sh53 billion used to extinguish syndicated loans. All the other claims, contradicting each other as they do, cannot be accepted devoid of any documentary evidence demonstrating cash inflows into the Consolidated Fund or other legitimate fund. In that case, Sh197 billion is missing.

10. From the different scenarios above, it is apparent that the Eurobond proceeds have not been accounted for in full, and the responsible government officials must be held personally liable for any money that is missing and/or was stolen, and for trying to hide the fact in fraudulent accounting.

11. Because the Government has refused to come clean by providing the information we requested in our letter, we filed the Petition to have the responsible officials put to strict proof on the bona-fides of their alleged transactions showing that the entire Eurobond money was spent to benefit Kenyans.

12. In the Petition we have sued H. E. President Uhuru Muigai Kenyatta, H. E. Deputy President William Samoei Ruto, Treasury Cabinet Secretary Hon. Henry Rotich, Treasury Principal Secretary Mr. Kamau Thugge, and the Hon. Attorney General. The Interested Parties in the case are the Controller of Budget Ms. Agnes Odhiambo, Central Bank Governor Dr. Patrick Ngugi Njoroge, and Auditor General Mr. Edward Ouko.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.