×

The Standard e-Paper

Smart Minds Choose Us

Dear Dr Pesa,

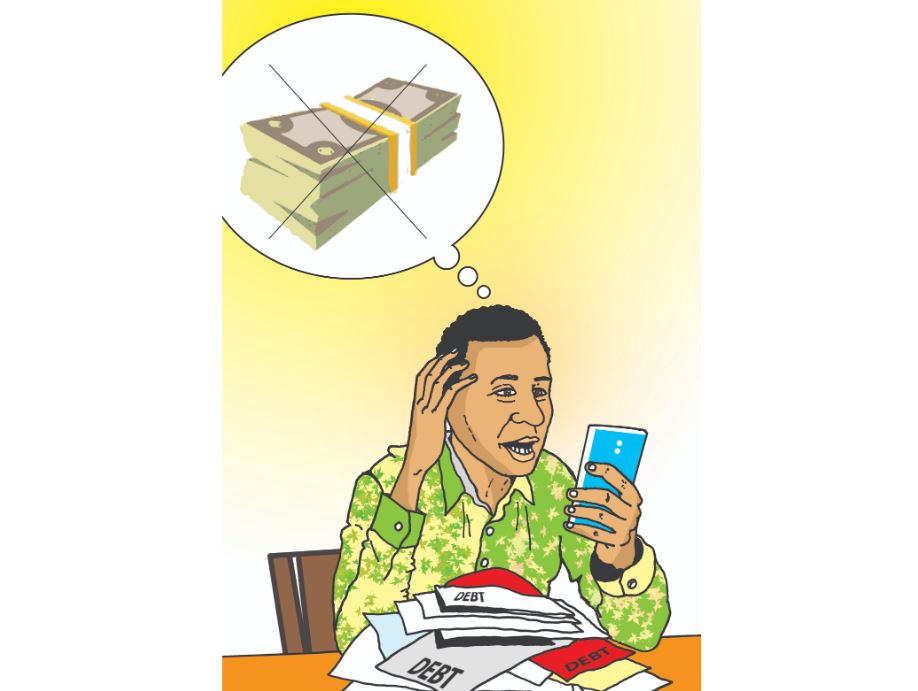

I am a 31-year-old man and deep in debt. Auctioneers, banks and even the landlord are all after me. My business is failing and I have no way to pay them back. I tried shylocks but that just left me drowning in debt. Should I file for bankruptcy? Will it haunt me for the rest of my life?