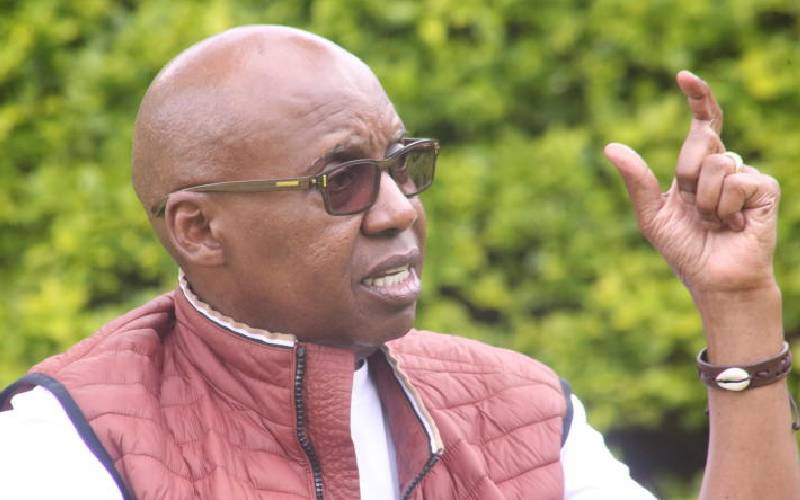

Azimio leader Raila Odinga has accused President William Ruto of misleading Kenyans by politicising matters arising from bad advice outside the civil service.

In reference to the debate on tax evasion linked to former Presidents Jomo Kenyatta and Daniel Moi, Raila argued that the information was incorrect and misleading.

"The bad advice Kenya Kwanza leadership is going public with is definitely not coming from civil servants. Instead, it points to the strengthening of the criminal mafia networks within government," he said.

Last week, a debate ensued online as to why the former Presidents had a law gazetted exempting them from paying estate inheritance tax while all other Kenyans were subject to the law.

According to the Estate Duty Act Cap 483 of 1963, a tax known as estate duty shall be levied and paid on all property of which the deceased was at the time of his death competent to dispose of and all property in which the deceased or any other person had an interest ceasing upon the death of the deceased.

Quoting parliamentary Hansards, the ODM leader argued that even though the law did exist, it was repealed in 1982 and is no longer operational.

"The highest level of government appears to be relying on bad advice from incompetent or malicious staff with extremely poor judgment," he said.

- Community health workers boost counties universal healthcare bid

- Inside UON's digital health facility

- Cabinet okays NHIF scrapping if four bills get MPs nod

- Time to reform ineffective tobacco excise tax policy

Keep Reading

Raila claimed that due to the government's "poor judgement" Kenyans have faced various challenges such as increased taxes, removal of subsidies on electricity, education and food, as well as the transfer of medical cover for some state officials from the publicly-owned National Hospital Insurance Fund to private insurance companies.

The Azimio leader explained that in 1969, Estate Duty Act Cap 483 of 1963 was amended to exempt Mzee Jomo Kenyatta's property from being subject to estate duty. In 1981, a further amendment was effected to exempt President Moi from payment of the tax.

Shortly after the passage of the amendment exempting Moi from the tax, Parliament repealed the law in its entirety through the Estate Duty (Abolition) Act 1982 which was assented to by President Moi on June 25, 1982, its commencement date being June 28, 1982.

Section 2 of the law provides that "no estate duty shall be levied or paid on property which passes on the death of any person dying on or after 1st January 1982."

"The parliamentary Hansard archives indicate that on June 9, 1982, then-Attorney General, Joseph Kamere, explained that the abolition of the Estate Duty Act was being proposed because it had become a big burden to the beneficiaries of the deceased," said Raila.

Kamere argued that the law had become "a big load to the beneficiaries of the deceased's property some of which had loans".

According to the Hansard, the repeal of this law got support from the likes of the late Martin Shikuku and then Minister for Lands and Settlement, G G Kariuki. They argued that the concept of collecting money from the deceased went against the cultural norms and beliefs of the people.

Raila's statement comes hours after the National Assembly Minority leader Kimani Ichung'wa stated that the government has commenced a fact-finding mission to identify individuals and companies that have been exempt from paying taxes since 2018.

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.

The Standard Group Plc is a multi-media organization with investments in media platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and international interest.