×

The Standard e-Paper

Fearless, Trusted News

The Central Bank of Kenya (CBK) has blamed “bad handling habits of notes” for worn-out new-generation currency notes in the market.

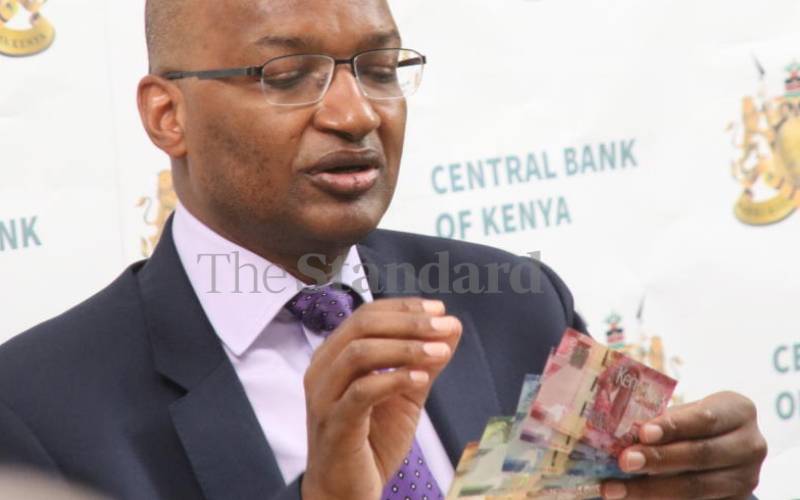

Appearing before the Senate Committee on Finance and Planning on the quality of new-generation notes, CBK Governor Patrick Njoroge reaffirmed his confidence in the new currency, which he said is “technically superior” to the old ones.