A group of financial consultants have asked Parliament not to ratify a proposal by Treasury to increase Capital Gains Tax (CGT) to 12.5 per cent.

They said the punitive levy could scare away investors, dealing the struggling economy another blow.

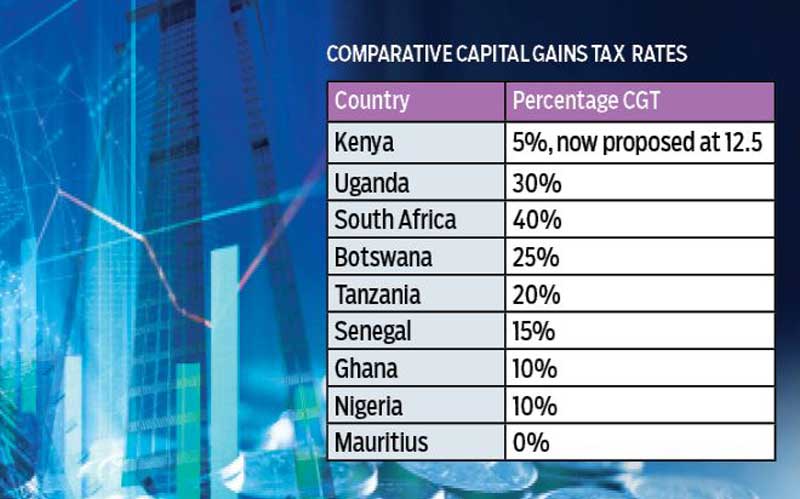

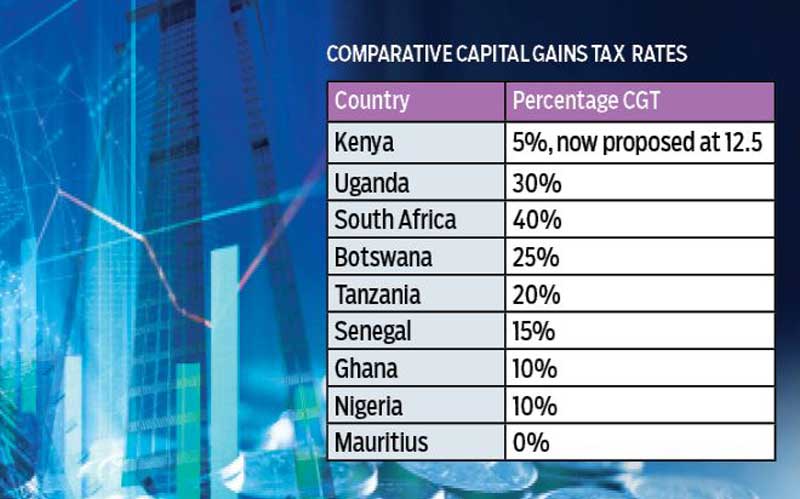

Financial experts Patrick Nderitu, Hedrick Omanwa and Romano Wachiye noted that at a rate of 12.5 per cent, transferring property in Kenya will be more expensive compared to its peers, Ghana and Nigeria.

At the current rate of five per cent, only Mauritius, largely seen as a tax haven, offers a lower CGT than Kenya at zero per cent.

CGT is levied on profits made after transferring property, including land, building and shares.

“Kenya is already more competitive for investments that some of its peers. Thus may lose some of this competitiveness to Ghana and Nigeria which have a lower CGT rate (10 per cent compared to 12.5 per cent),” the three independent consultants told the National Assembly’s Finance Committee in their contribution on the Finance Bill, 2019 at Parliament buildings last week.

They said the proposal should be shelved until the cases that are currently in the Court of Appeal challenging it are dispensed.

Some of the court cases filed against KRA due to what the trio described as “administrative challenges” to CGT include one by the Kenya Association of Investment Banks, Kenya Bankers Association and Law Society of Kenya.

“The contentious matters are lack of public participation before the introduction of the law, responsibility for payment of CGTN on auctioned properties by banks and simultaneous payment of stamp duty and CGT,” said the trio in their presentation to the House committee.

Currently, CTG is taxed at five per cent and does not include selling of land with a value of less than Sh3 million; transfer of securities listed on the Nairobi Securities Exchange; exchange of property due to incorporation, recapitalisation, separation, dissolution, or acquisition.

Selling of agricultural land by individuals outside of a municipality and transfer of property between spouses, however, does not also attract CGT.

Requires sensitisation

CGT’s poor performance, the trio said, has largely been as a result of many administrative exemptions that made it a “distortive tax.”

CGT was re-introduced after 30 years on January 1, 2015, with the rate pegged at five per cent.

Stay informed. Subscribe to our newsletter

However, the performance, according to the consultants, has been poor with KRA estimated to have collected Sh1.9 billion in the financial year 2018/19 against an annual target of Sh6.9 billion.

Treasury in its records estimates that KRA collected Sh4.1 billion from CGT in the financial year that ended June 31.

In the financial year 2017/18, KRA collected Sh16.6 billion from CGT.

The three experts said the reintroduction of CGT after 30 years requires sensitisation.

They described CGT as a “distortive tax” with numerous administrative exemptions.

Another administrative challenge is the fact that the records on acquisition costs and other allowable expenses on properties subject to CGT are not well preserved, making it hard for KRA to impose the levy.

CGT was reintroduced through the Finance Act, 2014 to ensure fair sharing of the tax burden, minimise speculation as well as tax avoidance and evasion.

In addition to the five per cent CGT, transfers in the extractive industry in the country (mining and petroleum industry) also attract the tax at the rate of 30 per cent for residents and 37.5 per cent for non-residents with permanent establishments in Kenya.

The person transferring has the responsibility of making the tax payments.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.