×

The Standard e-Paper

Join Thousands Daily

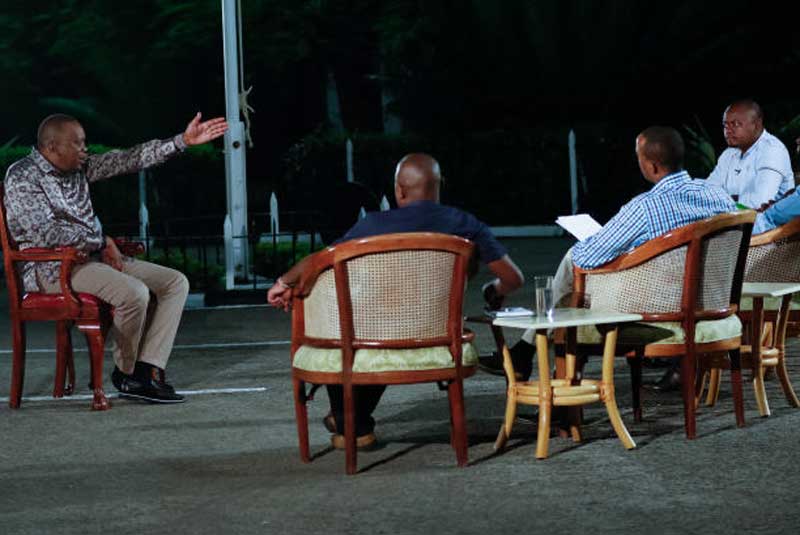

President Uhuru Kenyatta, in a recent televised interview, told a panel of broadcast journalists that all the money his Government borrowed had been put into good use.

Because of this, he said, he would continue borrowing - as long as the money gets into development activities such as roads, railways, ports and energy projects, “ I will borrow again and again,” he said