×

The Standard e-Paper

Smart Minds Choose Us

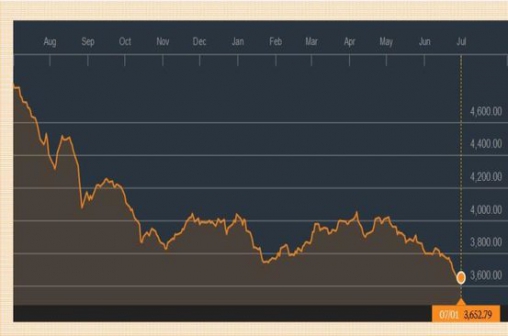

Eight in 10 stocks on the Nairobi bourse are in the red in a bearish market that has seen investors lose about Sh55 billion since January.

An analysis of Nairobi Securities Exchange-listed companies by Weekend Business, only 12 of 64 counters are in green while a massive 52 stocks, being 82 per cent of the market, are in red.