×

The Standard e-Paper

Stay Informed, Even Offline

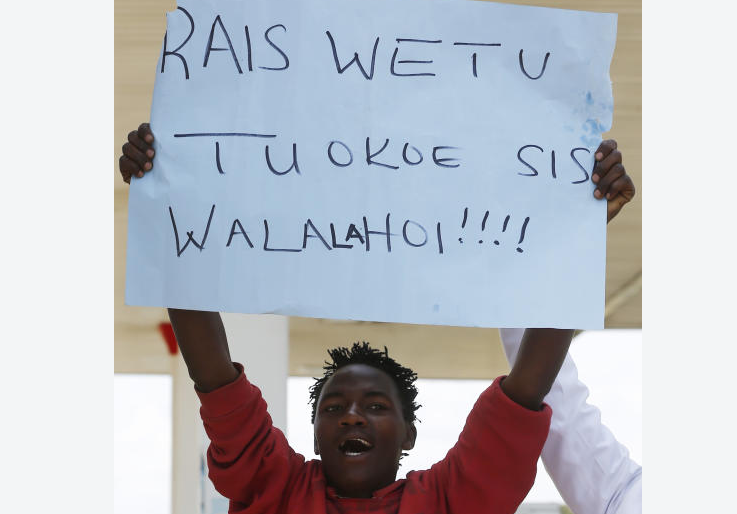

Legislators are divided over new taxation and cost-cutting proposals pushed by President Uhuru Kenyatta.

The rift widened ahead of the crucial special sitting of the National Assembly tomorrow afternoon to consider the President’smemorandum detailing his reservations about the Finance Bill 2018 and supplementary estimates outlining various budget cuts.