|

|

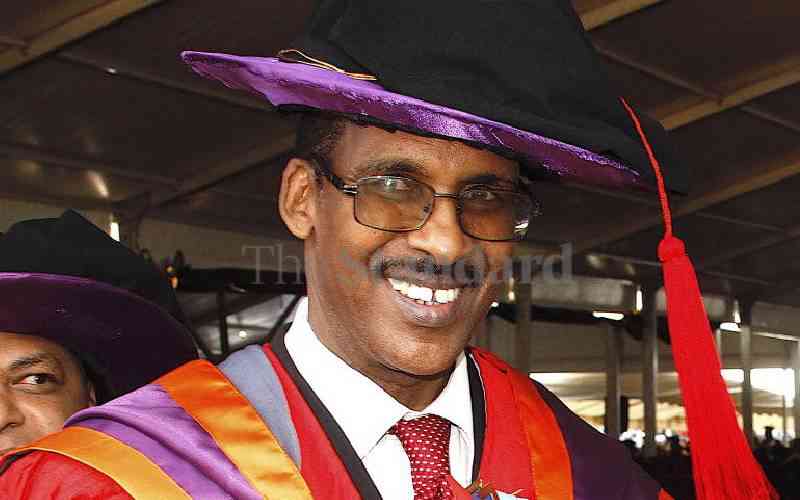

National Treasury Cabinet Secretary Henry Rotich. |

Kenya will review its economic growth target for this year after it recalculated the size of the economy, a move that led to a jump in annual growth rates, the Central Bank of Kenya’s (CBK) governor said Monday.

Government officials put 2013’s Gross Domestic Product (GDP) at $53.4 billion, 25 per cent higher than previously stated, after updating the base year for its calculation.

Growth for 2013 was revised up to 5.7 per cent from 4.7 per cent. The higher growth trend was confirmed when the statistics office said the economy expanded by 5.8 per cent in the second quarter, up from 4.4 per cent in the first three months.

In September, National Treasury Cabinet Secretary Henry Rotich said Kenya was expected to grow by between 5.3 to 5.5 per cent in 2014, down from 5.8 per cent previously forecast. “The National Treasury (Finance ministry) will review the previous growth target that was based on the old GDP series and is expected to announce new targets,” CBK boss Njuguna Ndung’u told Reuters.

Prof Ndung’u said he expected the economy to remain resilient this year and in the medium-term mainly due to its diverse nature.

The 5.8 per cent expansion in the second quarter surprised many because it came about despite a slump in the tourism sector following a spate of attacks blamed on Islamists. Output from the construction, manufacturing and financial services rose during the period.

“Various economic and financial indicators including cement and electricity production and consumption coupled with the sustained confidence in the economy suggest a continued pick-up in economic activity,” he said. He also cited increased foreign direct investment in transport and energy infrastructure, declining commercial lending rates and improvement in the management of spending by new local government units called counties.

Excess liquidity

Meanwhile, Central Bank said Monday it was seeking to mop up Sh8 billion ($89.64m) in excess liquidity in the market, via repurchase agreements (repos) and term auction deposits. The shilling edged up to 89.25/45 to the dollar following the announcement, after trading around the 89.40/50 mark. The bank has frequently taken such action, which tends to make it costlier for investors to hold long dollar positions and therefore helps bolster the shilling.

The shilling held steady in early trade, hovering close to 89.50 to the dollar, which is around the level where the Central Bank intervened to support the currency last month. Companies who usually seek dollars to meet end-of-month commitments were holding back to see if the Central Bank would again sell dollars to help the shilling. Traders said the firms would likely emerge as dollar buyers as the week progressed. At the opening of business, the shilling was trading at 89.40/50, the same as Friday’s closing level.

“We have not seen any significant interest from the corporates and we think we would only see a further move if we were able to break the 89.50 barrier,” said Duncan Kinuthia, head of trading at Commercial Bank of Africa. The shilling weakened to as low as 89.42/52 in early business on Monday before recovering.

Traders said a weakening beyond the 89.50-mark, seen as a psychological level, would draw out more dollar buyers and put further pressure on the shilling.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.