Had everything gone according to plan, Kenya would be preparing to start exporting its first consignment of commercially produced oil by the end of this year.

However, this has since changed and the optimism with which 2021 was labelled as the possible date for Kenya’s first oil payday has been moved to 2022, then 2023 and now 2024.

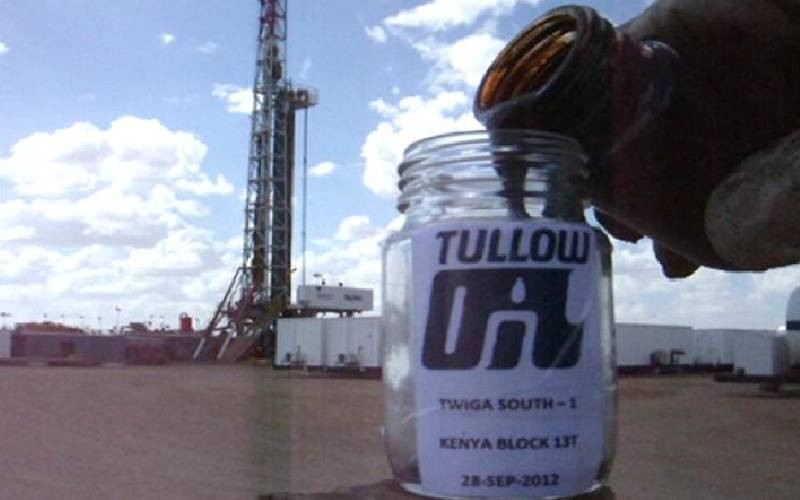

As recently as 2018, British exploration firm Tullow Oil had targeted a “Final Investment Decision (FID) for 2019 and First Oil for 2021/22.”

But the company has gone mute on when it expects to start commercial exportation of Kenyan oil, at least going by its just-published annual report.

Instead, the company said it expects to have a Field Development Plan (FDP) by the end of this year.

In its annual report for the year to December, the firm appears to have taken a cautious approach to Kenya, saying it had substantially scaled down its operations.

It has also cited failure to progress in Kenya as a major risk. It has previously said it is now giving West Africa, where it is already producing oil in Ghana, more focus.

But the government has put up a brave face, saying that it expects to export the first commercially produced consignment from the Turkana oil fields in 2024.

Petroleum and Mining Principal Secretary Andrew Kamau said the ministry expects the country to start exporting crude oil under the commercial plan by 2024.

He noted that low global oil prices are among the factors that have slowed down progress last year.

Oil prices tanked at the beginning of last year to an average of $17 per barrel (Sh1,853) in April, making investors edgy about putting money in the industry.

“We are still on track. One of the things that have diminished the speed that we have been working is the fact that prices have been so low in 2020. The other thing is that they (Tullow) could not travel within the country due to (Covid) restrictions,” Kamau told The Standard in a recent interview.

“We are currently doing public participation on Environmental and Social Impact Assessment, which could not be undertaken last year due to the restrictions, as well as doing land acquisition along the Lapsset (Lamu Port South Sudan-Ethiopia Transport) corridor where the crude oil pipeline will go through.”

But 2024 appears overly ambitious, considering that documents by both the company and the government indicate that constructing a pipeline from Lokichar to Lamu would take 36 months.

Stay informed. Subscribe to our newsletter

This would mean that the construction of the pipeline would have to start in the coming months for it to be completed and tested before it becomes operational.

The PS last week, however, said the government would penalise Tullow for any delays, with the penalties provided for in the production sharing contracts that the government has with the company.

Tullow has significantly slowed down its activities in Kenya, which is seen in the substantially reduced amount of money spent on local suppliers.

The firm in 2019 spent Sh3 billion on local suppliers, but the amount dropped by half to about Sh1.5 billion last year.

“In Kenya, Tullow’s 2020 spend on local suppliers was also approximately 50 per cent lower than in 2019, again as a result of a significant reduction in activity,” said the company.

In addition, the company cited the delays of the Kenyan project as among the key risks going forward.

“Key execution risks… include (being) unable to progress the preparation of Field Development Plan (FDP) in Kenya and therefore any exercise to unlock Kenyan potential,” said Tullow.

It added that it is engaging its “joint venture partners and the Government of Kenya to progress preparation of FDP in Kenya”.

The firm has in the past blamed the government for the slow pace of the project.

It had noted that land acquisition for developing both the oil fields and the pipeline as well as access to water rights for use in oil production had not moved as fast as expected.

Issuance of environmental licences, which is also a government function, has also experienced delays, although the firm had in the past been told to repeat one of the impact assessments by the National Environmental Management Authority (Nema), possibly an indication of its sloppiness at some point.

The company, in its latest annual report, also said it had written off Sh46.8 billion ($430 million) in exploration costs spent in Kenya, attributing it to low oil prices.

Kenya accounted for nearly half of the exploration write-offs over the year, which totalled $987 million (Sh106 billion).

In Uganda, the firm wrote off $451 million (Sh49 billion) in 2020, with the two East African countries accounting for 90 per cent of the exploration costs write-off.

It is the second year in a row that Tullow has made a major write-off on its exploration costs in Kenya, having written off Sh45.7 billion ($419 million) in 2019.

This has seen the firm’s remaining recoverable amount drop to Sh26.9 billion ($247 million).

Developing the Lamu oil fields has been projected to cost Sh300 billion, of which Sh100 billion will be used in building the 894-kilometre pipeline between Lokichar and Lamu.

Tullow has been the most successful oil explorer in Turkana and Kenya in general, with its other exploration works in other blocks not yielding much success.

The government, however, is optimistic about oil finds in other blocks scattered across the country, including some in the country’s territorial waters of the Indian Ocean.

The government in December gave Italian firm Eni an additional licence to drill exploratory oil wells in offshore Mombasa.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.

The Standard Group Plc is a

multi-media organization with investments in media platforms spanning newspaper

print operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a leading multi-media house in Kenya with a key

influence in matters of national and international interest.