×

The Standard e-Paper

Smart Minds Choose Us

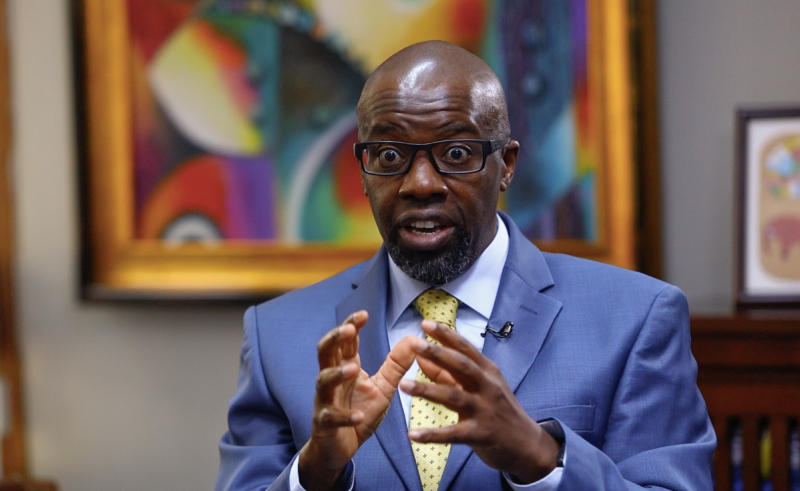

Liaison Group Managing Director Tom Mulwa [Courtesy]

Kenya’s pension funds have been known to be conservative in investments, choosing low-risk products such as government securities.