×

The Standard e-Paper

Kenya’s Boldest Voice

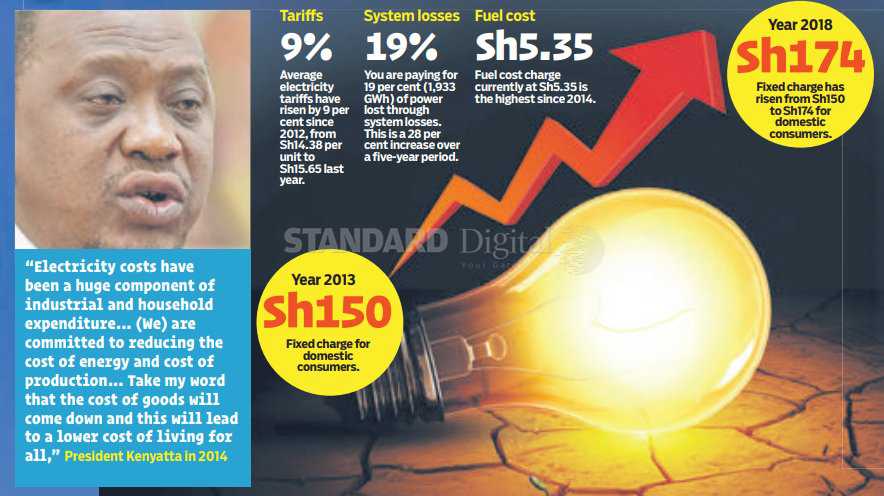

The State’s inability to explain the surge in electricity bills continues to raise queries on why the government is unable to stick to its key 2013 campaign pledge to bring down the cost of power.

Despite massive investments in geothermal power over the last five years, which essentially should have significantly brought down the cost of power, an analysis of government data shows this has not happened.