×

The Standard e-Paper

Home To Bold Columnists

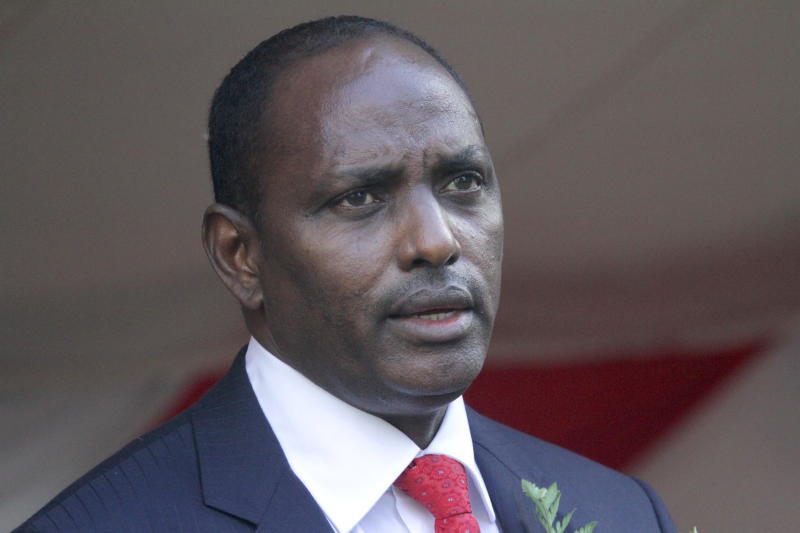

Treasury Cabinet Secretary Ukur Yatani presented the 2021/2022 budget yesterday. At Sh3.6 trillion, it is Kenya’s most expensive budget so far, and was presented at a time the country is knee-deep in debt.

After he was done with presenting the budget, ordinary Kenyans must have breathed a sigh of relief for being spared the pain of new taxes. However, they will have to contend with those that were listed months before the budget.