![Deputy Solicitor General Muthoni Kimani and Attorney General Githu Muigai at a Press conference in Nairobi yesterday. [PHOTO: JOHN MATUA]](https://cdn.standardmedia.co.ke/images/tuesday/AGG-20514-MAIN.jpg) |

|

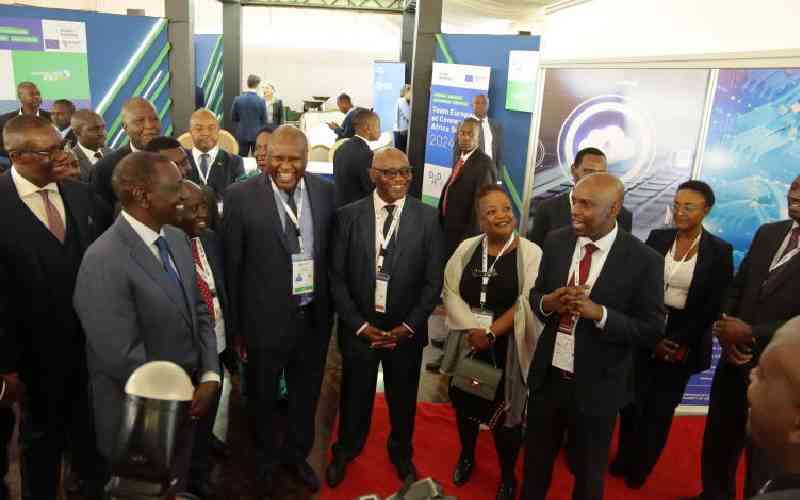

Deputy Solicitor General Muthoni Kimani and Attorney General Githu Muigai at a Press conference in Nairobi yesterday. [PHOTO: JOHN MATUA] |

By WAHOME THUKU

Kenya: The Law Society of Kenya (LSK) has now taken its fight with Attorney General Githu Muigai to Parliament over the multi-billion shilling Anglo Leasing scandal.

The lawyers’ body has petitioned the National Assembly to start the process of removing the AG from office over alleged violation of his constitutional mandate in regard to the handling of cases against the Kenyan Government in the United Kingdom.

In the petition signed by the chairman Eric Mutua (pictured) and secretary Apollo Mboya, the LSK asked the National Assembly to advise President Uhuru Kenyatta to initiate the process of removing the Prof Muigai.

The AG is on the spot over the handling of a case between the Government and the Universal Satspace (North America) LLC filed in London and another with First Mercantile Securities Corporation in Switzerland.

The process of removing an AG may, however, raise a legal debate due to a gap in the law. Article 132 (2) provides that the President may dismiss the AG in accordance with Article 156. However, Article 156 does not mention anything about the removal of the AG. It establishes the office, spells out the qualifications and the mandates of the office holder.

The President may, however, under the law remove the AG only for serious violation of the Constitution, gross misconduct, incompetence, mental or physical incapacity or bankruptcy.

In their petition, the LSK claims Prof Muigai failed to respond to five letters by the foreign advocate in England, who had been hired by the State to defend the suit.

“He failed to give instructions to the said Kenyan foreign advocate to file a reply to the application by the claimant, which sought to strike out the defence and counterclaim by the Kenyan Government. The application for striking out was therefore not contested in terms of the facts,” the application partly read.

The lawyers’ body pointed out that the AG failed to instruct a competent advocate with expertise in complex commercial litigation matters to represent Kenya in the London court.

LSK also criticised the AG for instructing the Solicitor General Njee Muturi to represent Kenya in the case, knowing that he did not have a license to practice law in England and Wales.

“Effectively the Government did not have legal representation and the proceedings in the court are a nullity,” the application read in part.

The LSK claims prof Muigai failed to advance the defence of corruption and bribery in the case, saying he instead recorded consent to take the matter for mediation and subsequently entered into a consent to pay $7.6 million (about Sh666.9 million as per current exchange rates).

This was despite the fact that reports by the Ethics and Anti-Corruption Commission, the Public Accounts Committee, PricewaterhouseCoopers and the Auditor General indicated the contracts were procured through corruption.

Unprofessional opinion

The AG failed to appeal against the court decision of December 20 last year even with an avenue to do so, the society argued in the petition sent to the Clerk of the National Assembly.

LSK claims the AG gave the Government unconstitutional, illegal, fraudulent and unprofessional legal opinion that the government had no other option than to pay the company. The LSK said though President Uhuru Kenyatta had reprimanded the Office of the AG over the manner in which the cases were handled, no disciplinary action was taken.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

![Deputy Solicitor General Muthoni Kimani and Attorney General Githu Muigai at a Press conference in Nairobi yesterday. [PHOTO: JOHN MATUA]](https://cdn.standardmedia.co.ke/images/tuesday/AGG-20514-MAIN.jpg)