|

Inflation slowed for the 11th consecutive month last month, giving room for CBK to cut

its prime-lending rate by 200 basis points to 11 per cent from 13 per cent in September.

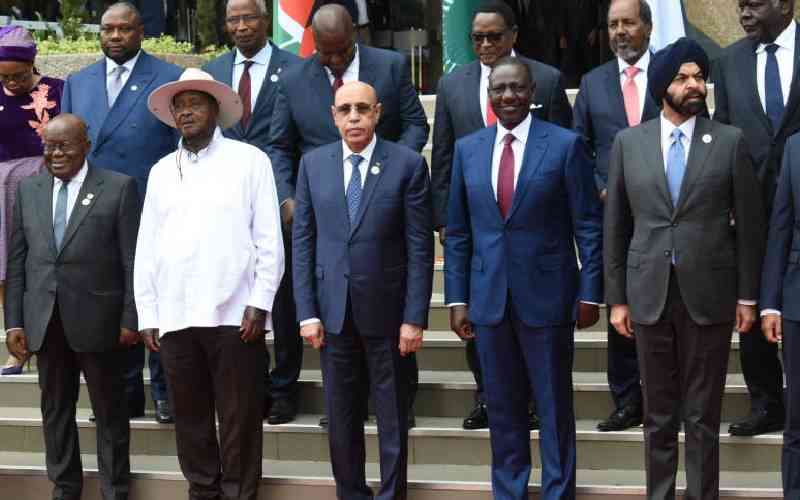

[PHOTO: MOSES OMUSULA/STANDARD] |

By James Anyanzwa

Currencies in the East African trading bloc are poised to come under immense pressure in the coming months, as member States import more goods and services than they export.

Citibank Group said though the macroeconomic fundamentals of the region remain bright, the widening fiscal and current account deficits pose serious threats to the region’s economic outlook.

Daniel Connelly, the bank’s managing director in-charge of Kenya and the East African region, noted that the twin deficits would hurt these economies through the depreciation of their currencies.

Fiscal deficit

Connelly pointed out that the situation has been exacerbated by the action of regional central banks to lower interest rates to spur household and business spending.

“Governments in the region have eased monetary policy in 2012 as the inflation rate has fallen; we have seen currencies in the region come under pressure in the final quarter of 2012. This trend is likely to continue unless central banks are prepared to continue to run tight monetary policies, which in turn will continue to attract portfolio inflows to fund the twin deficits,” he said.

Connelly explained that fast-growing economies such as those within the EAC are bound to suck in imports, but if these imports are consumer goods and not capital goods or investments then these imports are highly undesirable.

He said current account deficits are arguably more worrying than the fiscal deficit, when a government’s expenditure exceeds the revenues it generates.

“The reality is that current account deficits within the EAC are still substantial by any standard,” said Connelly.

International Monetary Fund (IMF) says the current account deficit of the five EAC members last year and this year has been above 11 per cent of the gross domestic product (GDP). This compares to about 2.5 per cent for Sub-Saharan Africa as a whole. “As an economist, I would be much happier with current account deficits of around five per cent of GDP, rather than double that size,” he added.

Tall order

“Where the clouds hang over the economic outlook for the EAC is the question of whether the deficits on the fiscal and current account can be brought under control,” he said. The IMF is projecting that the fiscal deficit in Kenya, Uganda, Tanzania, Rwanda and Burundi will come down to 3.9 per cent next year, compared with 4.7 per cent this year. But this in part depends on Ugandan halving its deficit from about six per cent of GDP this year, to three per cent, next year.

“This is potentially a tall order and it may well prove that the fiscal consolidation is more modest. It may also be that the Kenya slips on its fiscal targets in early next year, or around the elections, although it will have some time to bring spending back under control over the rest of the year,” said Connelly.

Citigroup views the East African Community market as a new frontier for growth.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.