×

The Standard e-Paper

Stay Informed, Even Offline

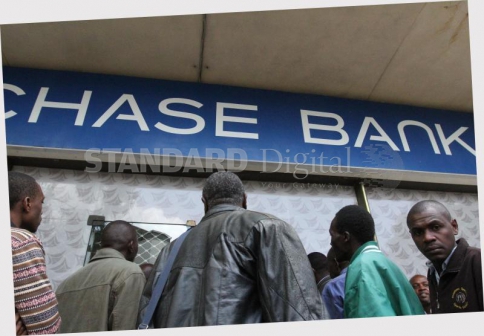

NAIROBI, KENYA: Funds locked up at Chase Bank over the last two and a half years will be available at the rebranded State Bank of Mauritius counters on August 20.