×

The Standard e-Paper

Smart Minds Choose Us

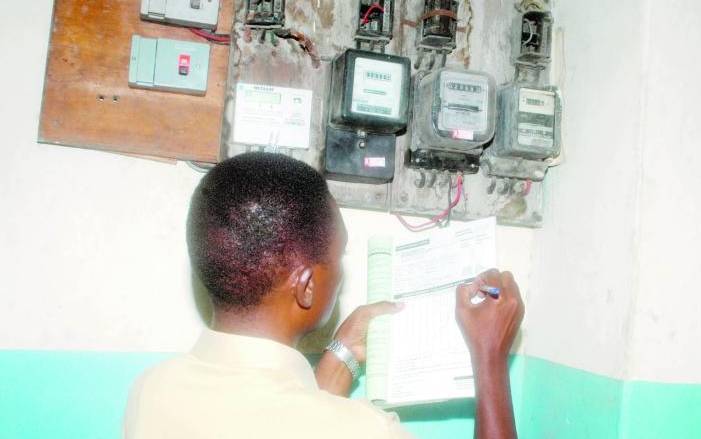

Kenya Power has started the process of eliminating the use of estimates to bill its post-paid customers.

The power distributor yesterday unveiled a mobile platform through which customers can take their metre readings and submit them to the company for the processing of their monthly bills. The readings will later be verified by the firm’s officials.