×

The Standard e-Paper

Stay Informed, Even Offline

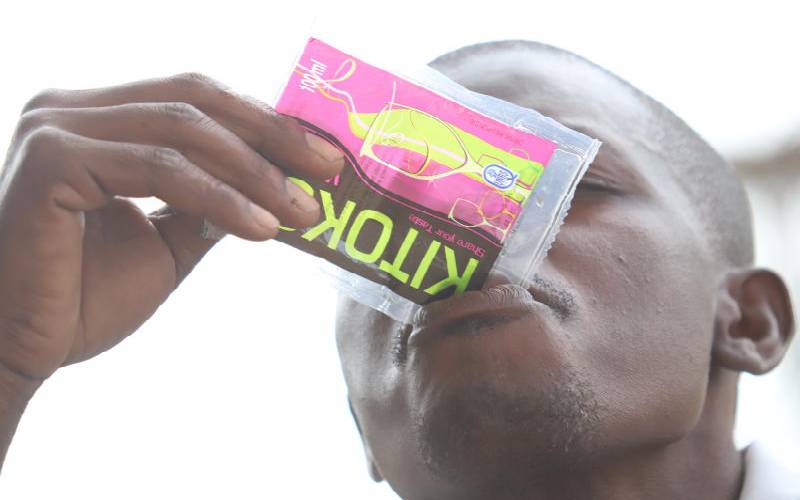

Manufacturers and distributors of alcoholic beverages have protested the hike in excise duty on wines and spirits by 15 per cent in this year’s budget.

Under the aegis of the Alcoholic Beverages Association of Kenya (Abak), they said the move would not only curtail the industry’s growth but would also reverse the gains made in the fight against illicit brews.