×

The Standard e-Paper

Join Thousands Daily

A credit firm is on the spot after a number of civil servants accused it of making them service loans they never applied for.

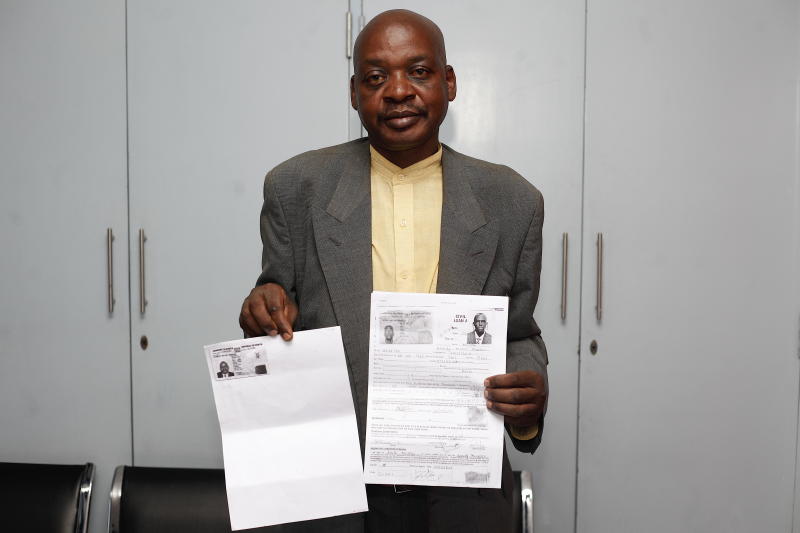

The civil servants, among them Assistant County Commissioner Hesbon Kayesi, are at a loss after their salaries were deducted to pay for loans said to have been taken from Platinum Credit.