×

The Standard e-Paper

Stay Informed, Even Offline

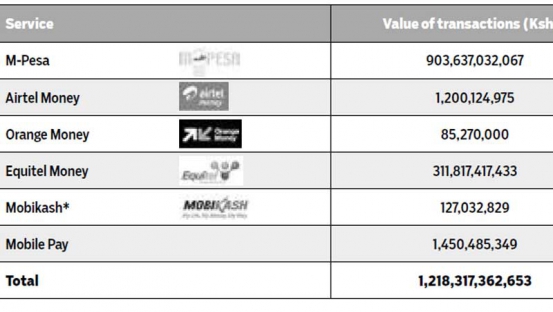

Kenyans transacted Sh1.2 trillion on their mobile phones between April and June this year.

This means they transacted Sh400 billion a month or Sh13 billion in a day.