×

The Standard e-Paper

Fearless, Trusted News

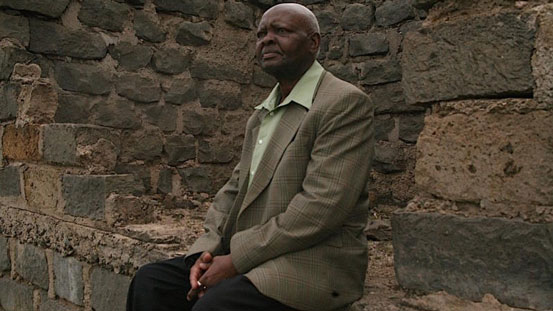

On Friday, a fortnight ago, Michael Lang’at, 76, entered National Bank of Kenya (NBK) head office along Harambee Avenue. This was one in many of the trips that he had been making to the bank since February 1995.