×

The Standard e-Paper

Home To Bold Columnists

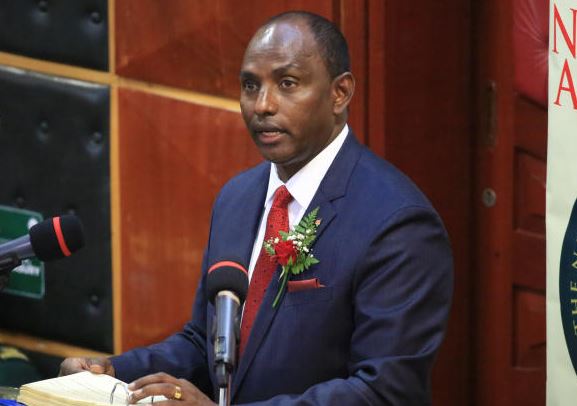

Treasury CS Ukur Yatani. [Elvis Ogina, Standard]

Parliament has taken the government to task over a rise in public debt and recurrent expenditure, setting the stage for a new push in cutbacks to State spending.