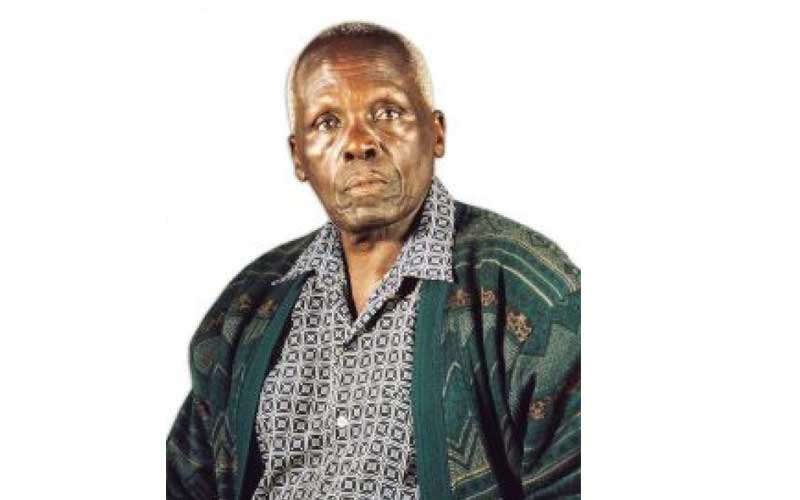

If you have been fascinated by the rags-to-riches stories of the late politician Njenga Karume and Nakumatt Supermarket’s founder Mangalal Shah, then your excitement must have been deflated.

Last week must have been a watershed moment for the two business empires that were built from scratch to splendour without succour.

The week saw the behemoths that the two patriarchs built spoken of as objects of the past. Sympathisers of Nakumatt Supermarket might as well have paid their last respects to the once regional retail giant.

Started some 40 years ago by Mangalal, father of Atul Shah, the retail chain will soon join a rich graveyard of the country’s supermarkets. This is after creditors of Nakumatt voted to have it wound up.

For the late Karume’s Jacaranda Hotel, it might need the services of a corporate undertaker. It was the third time the hotel belonging to the once-powerful Kenyatta era and Kibaki era minister was being auctioned.

If things continue to be in the same course, it is just a matter of time before Jacaranda also has a date with a corporate undertaker.

A business, like any human being, has to die at some point - though, and again just as humans, some tend to have longer life spans than others.

Because, as they say, blood is thicker than water, Karume and Shah entrusted their businesses with their children. There was some logic in their decisions. They believed that their children would protect their visions. But they were wrong.

For Karume and myriad of other family businesses, the old man might have had some insight on how he expected the business to be run, distributing some wealth generously to his children and grandchildren.

He also had a plan on how he expected his estate to be run after his demise and appointed a trustee.

Yet, seven years later, his children and trustees are still jostling for the estate. Lawyers continue to pocket billions of shillings in legal fees even as some of Njenga’s children die due to lack of medical attention.

For Atul, one of the children of Mangalal, he seemed to do so well at first, but failed to realise that the business had grown heavier to stand feeble pillars provided by a few family members.

Atul did realise that, but it was too late. In an interview with the Sunday Standard’s Weekend Business, Atul talked of having had his Damascus moment. He said after sitting in many meetings, he concluded that corporate governance at the supermarket was still wanting. “The family shall never be a hindrance to the growth of Nakumatt. That I promise,” said Atul.

It is not just the Karumes and the Shahs that have presided over the uneventful collapse of their business empires; there are numerous cases of how poor succession plans have cut short the lives of many flourishing family businesses. In most cases, the founders have simply died with their visions.

Perhaps, it is the fault of the founders who did not prepare well for a time when they would not be there to run their business as they wished.

Karume died on February 24, 2012. He left behind huge cash, but certainly not a concrete succession plan.

He left behind some Sh300 million that would cover unforeseen events and medical bills. But since then, even succession planning has not served to improve business relations among families. It only added feuds.

“These court battles are bad publicity for both the families and their businesses. It is not the best way to appreciate the hard work of those patriarchs who built these empires. My take is that most of these battles are as a result of greed and lack of mutual respect in these families,” said President Uhuru Kenyatta in Murang’a during the burial of Kamau Thayu Kabugi, an oil tycoon.

Enashipai Resort

Former Starehe MP Gerishon Kirima is one of the Murang’a tycoons, whose heirs have been fighting each other in public glare.

Another one is the businessman and founder CEO of Equity Bank John Kagema, who died in December 2018. He was the owner of the luxurious Enashipai Resort and Spa in Naivasha. The properties that Kagema’s widows and children are fighting for include 21 companies, an insurance policy, at least 118 plots of land countrywide, a mining company, and a fleet of motor vehicles.

Former Minister John Michuki (deceased) has not been spared, even after it appeared as if he had not left any stone unturned.

Towards the end of 2018, one of his daughters went to court blaming her two siblings who were given powers by the High Court to administer the estate, of having accumulated huge debts at Nairobi Hotels Ltd, which owns a big share of the Windsor Golf Hotels and Country Club.

A report released in 2016 by consultancy firm Knight Frank found that Kenya’s wealthy proprietors of family businesses do not prepare their children to take over, exposing such enterprises to the risk of collapse.

Without a clear succession plan or will in place, many families have been exposed to fall-outs.

Most of the billionaires, noted the Knight Frank Global Wealth Report, had reservations on their children’s ability to manage their businesses after they were gone.

Share capital

Nine of 10 businesses in Kenya - and even globally - are family-owned. Audit and consultancy firm PricewaterhouseCoopers (PwC) defines a family businesses as one in which there is at least one representative of the family or kin formerly involved in the governance of the firm.

Family businesses are not necessarily private, they can also be listed.

READ ALSO: Secretive Kenyan billionaires you might not know about

If publicly listed, the persons who established or acquired the firm from their families or descendants enjoy at least 25 per cent of the decision-making rights mandated by their share capital.

Data shows that family businesses contribute about 60 per cent of employment in Kenya.

“Unfortunately, most family businesses are averse to seeking outside help, fearing to enlist the help of outsiders. This apprehension may stem from their concern about whether the family’s vision for the business will be truly understood and honoured,” points out a Family Business Survey for 2017.

Atul, together with his brother, Vimal Shah, helped revive their father’s business when the old man had been declared bankrupt.

Vimal worked so hard to pay off his father’s Sh1.2 million debts. But the expansion frenzy was its undoing.

Yes, businesses fail, but the failure to enlist outside help and allow for professional management has been the reason for the death of most of those owned by families.

The Shahs, who were chatting the Walmart way then, ignored these brutal facts.

Pradeep Paunrana, former chief executive officer of cement maker Athi River Mining (ARM), wept when he decided to give out a stake to an outsider. But even this was not enough, as the company was recently acquired by Devki Group of Companies.

Starting a cement making company was the dream of late Harjivandas J Paunrana, father to Pradeep.

“I remember him telling me: “You see that line of trucks waiting to carry cement at the East African Portland Cement Company (EAPCC), waiting for two to three days at a time? This is a business that we should go into because there is a huge demand and we have got to fulfil that demand,” Pradeep was quoted telling the news site, How We Made It in Africa.

ARM was founded in 1974 by Pradeep’s father, the late Harjivandas J Paunrana. Pradeep, just as Atul, was always around to see his family business grow from a small producer of agricultural lime to become one of the country’s biggest cement manufacturers. But, like Nakumatt, the rapid growth came at a cost.

In its expansion overdrive, the company accumulated so much debt that it was inevitable that Pradeep’s family had to cede some ownership to make way for the entry of a strategic investor who could help make the company afloat. It was a heart-wrenching moment for Pradeep.

An irredeemable stain on Nakumatt’s corporate governance structures might have well informed its reluctance to go public, with some reckoning that the supermarket was nothing but a vehicle for cleaning dirty money.

But had it gone public, it would not have been the first Kenyan family business to do so. Several family businesses are listed at the Nairobi Securities Exchanges (NSE).

The Ndegwa’s NIC Bank, Agakhan’s Nation Media Group, Pradeep’s ARM and Merali’s Sameer Group are just a few among others that have taken this path.

Flame Tree Group, which deals in first moving consumer goods, and founded by Heril Bangera, is also listed at the Nairobi bourse. Huge conglomerates globally started as family businesses but as they expanded to spread wings overseas, they shed their family tag.

READ ALSO: Fighting over daddy’s billions

Samsung and BMW are some family businesses that over the years have been able to manage succession.

Analysts say one of the best ways for a family business to grow is through diversification, which is also a good way to control family squabbles - an Achilles’ heel for most family-owned entities.

An example is Simba Corporation, which is now better capitalised, having divested into different industries.

The family sold its stake at the East African Building Society to Nigerian investors and got more capital it used to strengthen its motor vehicle business.

They have also moved into hospitality, with a majority stake in Kempinski Hotel and also gone into mining through Acacia Mining.

A recent survey by PwC notes that family businesses, like all others - have grown to be more complex. Nearly two-thirds of family firms surveyed say they plan to take in professionals.

But are other family businesses taking note? Tuskys Supermarkets is yet another family-controlled business that has experienced some family feud.

Founded by Joram Kamau - and now owned by seven children after his death in 2002, the retail chain had been a subject of court battles. Kamau’s children had been fighting for control of his estate, accusing and counter-accusing one another.

In 2017, two of its directors were dragged to court for stealing Sh1.6 billion from their company, with their lawyer noting that the case against them was “an extension of a family tussle.”

“The complainant, Yusuf Kamau, herein wants them incarcerated so that he can control the vast business empire,” said lawyer Saibabo Kanchori.

Yusuf is a brother to the accused - Stephen Mukuha and George Gachwe.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print

operations, television, radio broadcasting, digital and online services. The

Standard Group is recognized as a

leading multi-media house in Kenya with a key influence in matters of national and

international interest.