×

The Standard e-Paper

Stay Informed, Even Offline

The Central Bank of Kenya (CBK) is set to develop a new system that will enable financial service providers to identify their customers electronically.

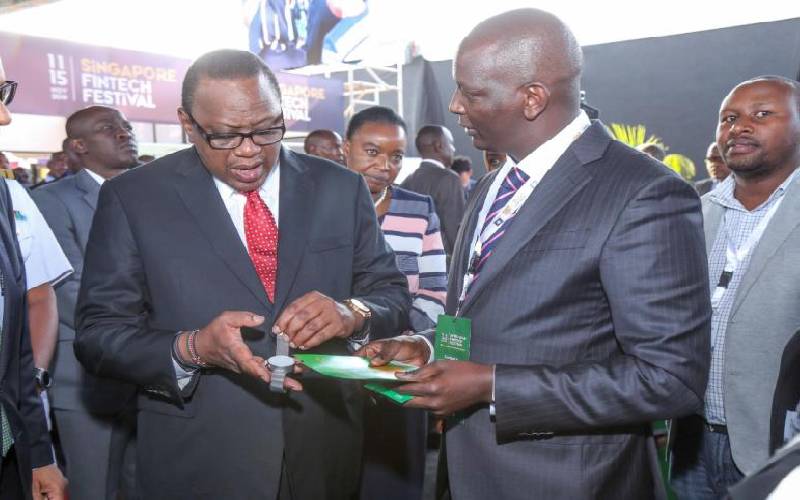

CBK and the Monetary Authority of Singapore (MAS) on Monday signed a Memorandum of Understanding to co-develop infrastructure on identity, data and electronic Know-Your-Customer (KYC) procedures. The new system is expected to offer an efficient and more credible way for banks and other service providers to identify their customers.