×

The Standard e-Paper

Home To Bold Columnists

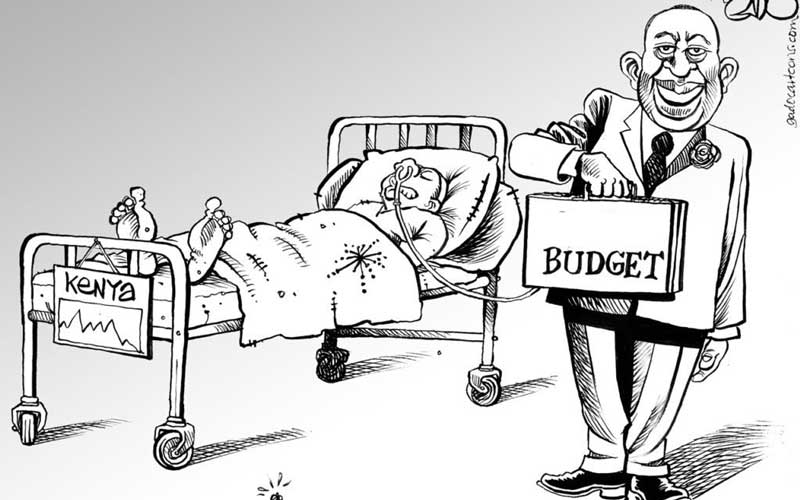

One area we have failed as a country to contain is our huge appetite to spend more. To spend, in many instances, what we don’t have. Once again, Treasury Cabinet Secretary Henry Rotich has kept the Budget estimates very high.