×

The Standard e-Paper

Smart Minds Choose Us

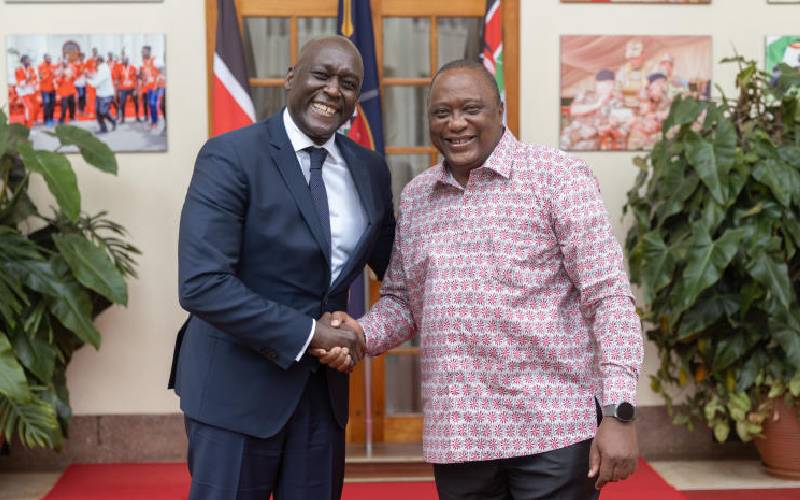

President Uhuru Kenyatta and IFC Managing Director Makhtar Diop shortly after meeting a high-level delegation led by Diop at State House, Nairobi, February 2022. [Courtesy]

The International Finance Corporation (IFC), the private investment arm of the World Bank Group, has promised to help finance small businesses in healthcare in Africa.