×

The Standard e-Paper

Home To Bold Columnists

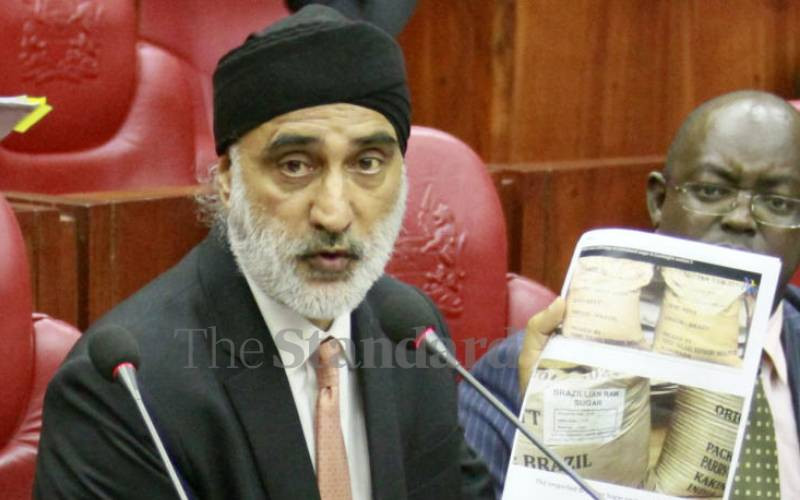

The Commercial Court in Nairobi has dealt Jaswant Rai a major blow in his battle with Butali Sugar over a milling license battle that started in 2007.

Justice Alfred Mabeya Friday awarded Butali Sh590 million, with 12 per cent interest from 2007.