×

The Standard e-Paper

Join Thousands Daily

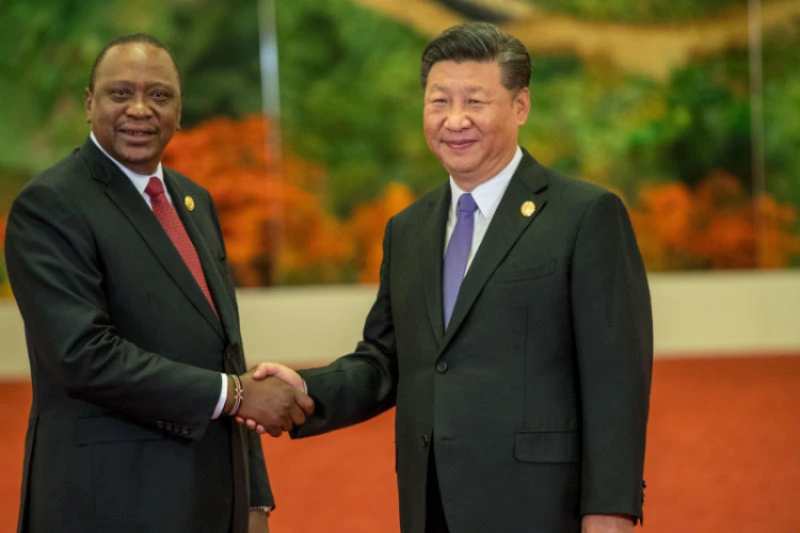

Friendship: Chinese President Xi Jinping (R) meets with Kenyan President Uhuru Kenyatta in Beijing on May 15, 2017. (Xinhua/Pang Xinglei)

In our second of a four-part series, we look at President Uhuru Kenyatta’s efforts to secure more Chinese funding for the extension of the Standard Gauge Railway and the attendant blessings and curses that came with billions from Beijing