×

The Standard e-Paper

Join Thousands Daily

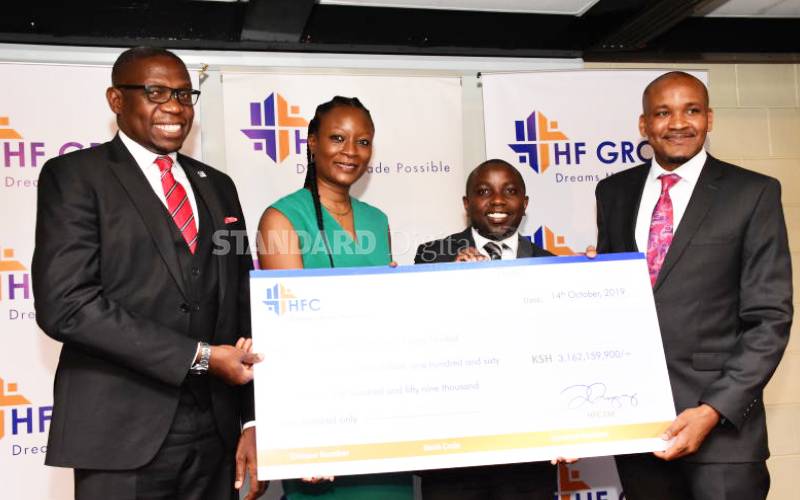

HF Group Chief Executive Robert Kibaara (right), his Nairobi Securities Exchange counterpart Geoffrey Odundo (left), MTC Trust and Corporate Services Managing Director Bukola Awasika and Co-operative Bank Head of Custody and Registrar Services Eden Kaberere when HF announced the retirement of its Sh3 billion corporate bond in Nairobi. [Wilberforce Okwiri, Standard]

The Housing Finance Group (HF) has retired its Sh3 billion corporate bond and vowed to keep off the debt instrument.