×

The Standard e-Paper

Kenya’s Boldest Voice

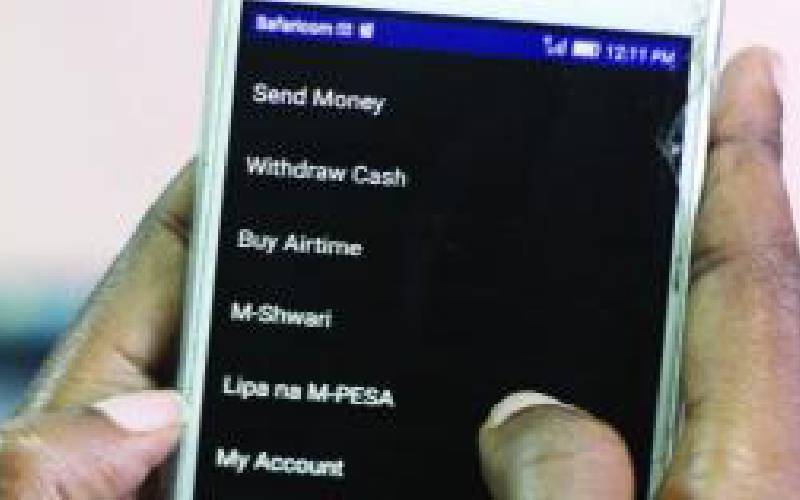

The number of mobile money transactions fell nearly 30 per cent in the first three months of this year, marking the largest decline recorded by service providers in recent years.