×

The Standard e-Paper

Stay Informed, Even Offline

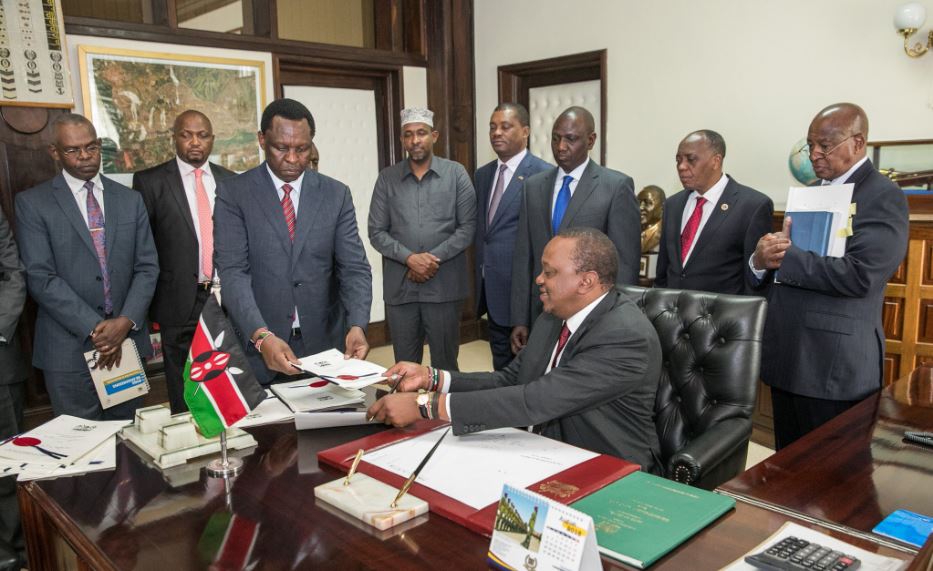

NAIROBI, KENYA: President Uhuru Kenyatta is on the receiving end of Kenyans’ rage after administering a series of crippling taxes as he moves to finance his latest pet project - the Big Four agenda.