×

The Standard e-Paper

Smart Minds Choose Us

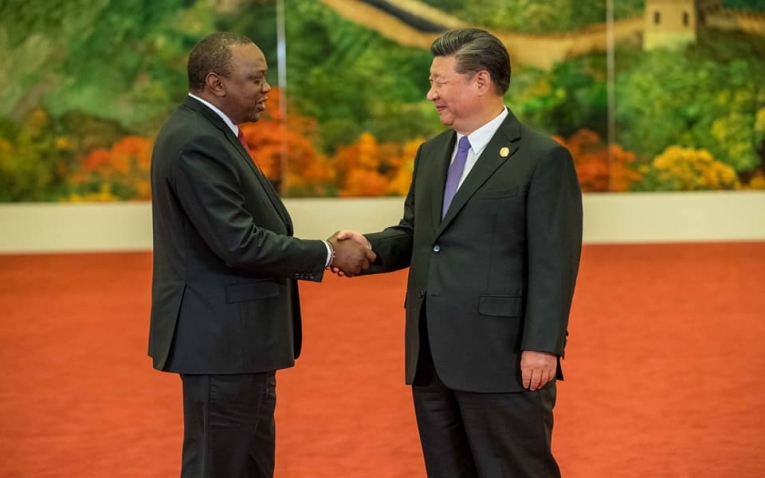

As Kenyans brace for the high cost of living from a 16 per cent tax introduced on petroleum products, President Uhuru Kenyatta is in Beijing China to undersign more debt that will erode Kenya’s efforts for fiscal consolidation fulled by the country's high borrowings.

This is the second time in as many years the President is in China after a similar trip last year that saw Kenya saddled with an additional Sh370 billion.