×

The Standard e-Paper

Stay Informed, Even Offline

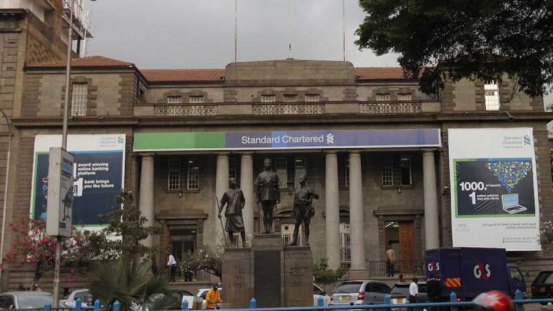

Defaults by big borrowers have plunged Standard Chartered Bank into a 39 per cent loss for the nine months to September this year.

Chief Executive Lamin Manjang said yesterday a downgrade on a ‘limited number’ of loan accounts coupled with the effect of lending rate caps contributed to the slowdown in earnings.