×

The Standard e-Paper

Join Thousands Daily

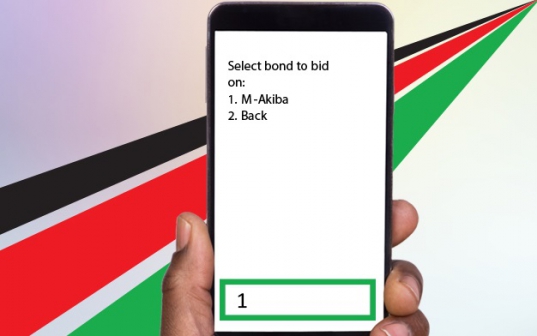

The National Treasury is facing an uphill task to raise ShSh888 million in less than 24 hours in the mobile-based M-Akiba bond that has only managed to get Sh112.5 million in 21 days.