|

|

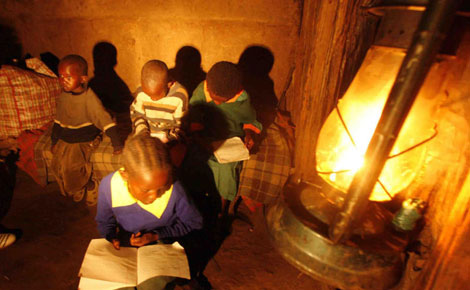

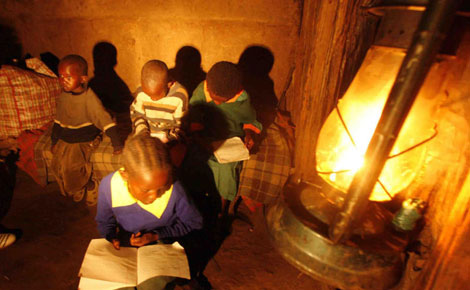

Pupils from the Samburu confirm they have completed their home work correctly using a kerosene lamp. Increasing taxes on the fuel will hurt the poor more. [Photo:George Mulala] |

Government will impose heavy taxes on kerosene in a move that could hurt low-income urban and rural households. Most of them use the fuel for cooking and lighting. The Energy Ministry expects to raise Sh7 billion from the planned taxes and duties on kerosene that will be used to develop the Liquefied Petroleum Gas (LPG) sub-sector.

The Senior Petroleum Economist at the Ministry of Energy and Petroleum, Mr Joseph Wafula, said taxes on kerosene are meant to discourage cartels from using the fuel to adulterate diesel and super petrol. It is also expected to grow the use of LPG, whose uptake in Kenya has for years stagnated at about 80,000 tonnes per year. This has been blamed on the high cost of acquiring equipment such as the gas cylinders and cookers.

"We are thinking of putting taxes on kerosene and removing the same from LPG so that we can minimise the element of people doing adulteration," said Wafula. " We also want to impose taxes on Kerosene to make it more expensive so that we can deviate the use of Kerosene in cooking to LPG."

Wafula was addressing a conference of both local and international LPG players during the First African LPG summit in Nairobi yesterday. The three-day event organised by the Petroleum Institute of East Africa (PIEA) brings together key players in the sector, who will define LPG growth, use as well as promote sustainable development in African.

Urban areas

Wafula noted that the penetration of LPG in Kenya is still low, at about seven per cent, with most consumption of the product concentrated in the urban areas.

"A huge percentage of LPG is used majorly for cooking of which 90 per cent is in urban areas," he said, adding that majority of Kenyans still use kerosene and biomass for cooking and lightning.

Statistics from the Ministry of Energy and Petroleum show that on the national level, wood fuel and other biomass account for about 68 per cent of the total primary energy consumption followed by petroleum fuels at 22 per cent, electricity at nine per cent and solar at less than one per cent. Wafula said consumption of LPG in Kenya is constrained by the availability because the demand, which is estimated at 200,000 metric tonnes annually, is greater than available supply.

It is estimated that if the constraints on LPG supply were removed, consumption would peak to 735,217 tonnes in 2035. According to PIEA, imposing taxes on kerosene would deter more Kenyans from using the fuel and take up LPG.

PIEA Chairman Polycarp Igathe noted that the necessity of clear policy shift from unsustainable energy options like biomass to cleaner modern options like LPG cannot be over-emphasized. " About 80 per cent of Sub-Saharan Africa households use wood fuel and charcoal for their primary domestic energy so the greater number of premature deaths especially among women and children happens in SSA," said Igathe.

" We are looking at how to promote greater penetration of LPG in the country. We want more Kenyans to use LPG as opposed to biomass. We are proposing to the Government to remove all taxes from LPG and lump them to kerosene. We should not have Kenyans using kerosene."

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.

The Standard Group Plc is a multi-media organization with investments in media

platforms spanning newspaper print operations, television, radio broadcasting,

digital and online services. The Standard Group is recognized as a leading

multi-media house in Kenya with a key influence in matters of national and

international interest.