×

The Standard e-Paper

Fearless, Trusted News

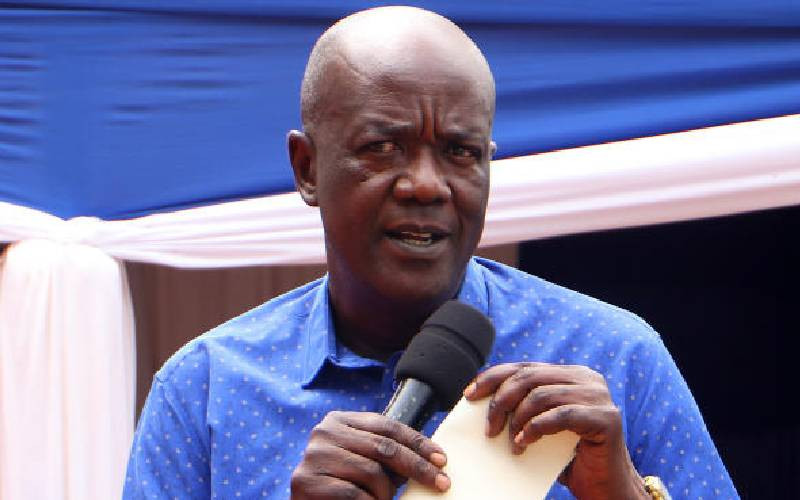

Kilifi Governor Gideon Mung'aro. [Robert Menza, Standard]

Kilifi governor Gideon Mung'aro on Saturday gave out Sh113 million in loans to several local firms including those that supply the county government to boost their businesses.