×

The Standard e-Paper

Smart Minds Choose Us

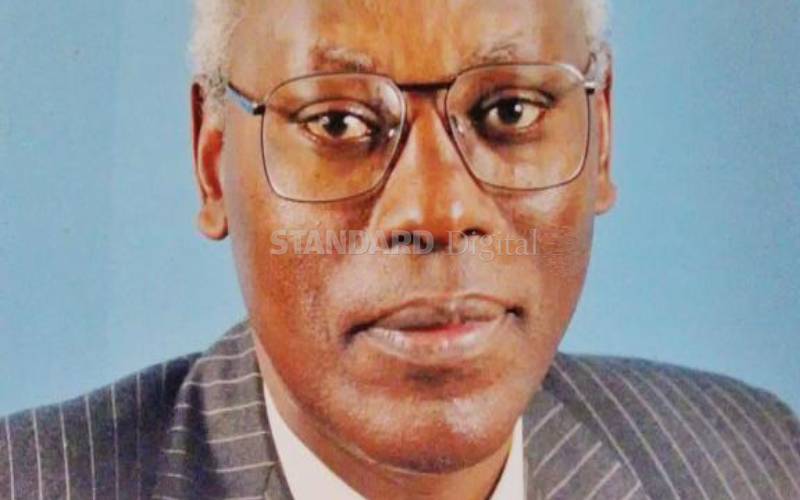

Former Central Bank Governor Philip Ndegwa.

Former Central Bank of Kenya (CBK) Governor Phillip Ndegwa gave a portion of his wealth to his in-laws, step-mother and step-siblings.