×

The Standard e-Paper

Home To Bold Columnists

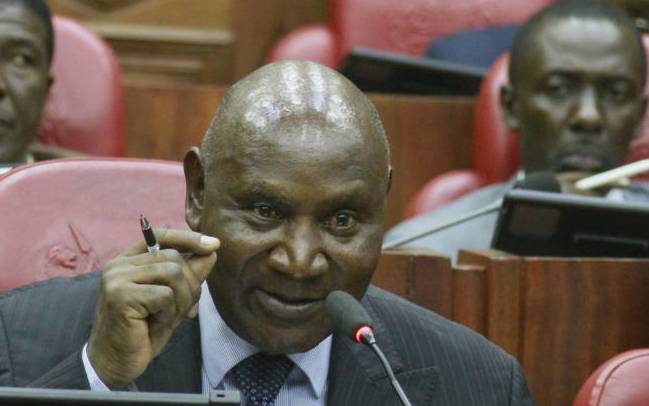

Auditor General Edward Ouko when he appeared before the Senate County Public and Investment Committee at County Hall, Nairobi on Wednesday 24/04/19. [Boniface Okendo,Standard]

A host of county assemblies risk losing millions of shillings in unpaid car loans and mortgages, an audit report has warned.