×

The Standard e-Paper

Kenya’s Boldest Voice

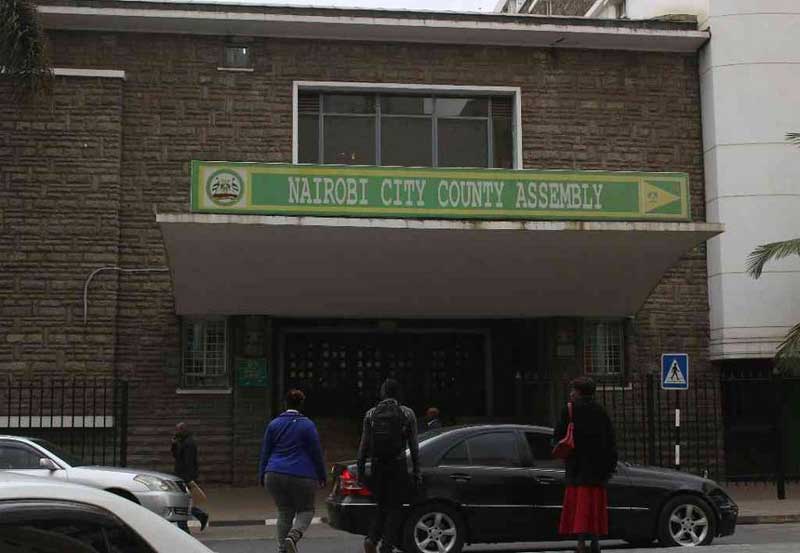

Journalists were yesterday barred from covering a meeting on car loans for Members of the County Assembly.

County Assembly Clerk Jacob Ngwele was being grilled by the assembly's watchdog committee over the irregular transfer of Sh45 million meant for the ward representatives' car loans.