×

The Standard e-Paper

Smart Minds Choose Us

Treasury has dismissed banks’ assertions that the cap on interest rates is to blame for the worsening credit crunch to the private sector.

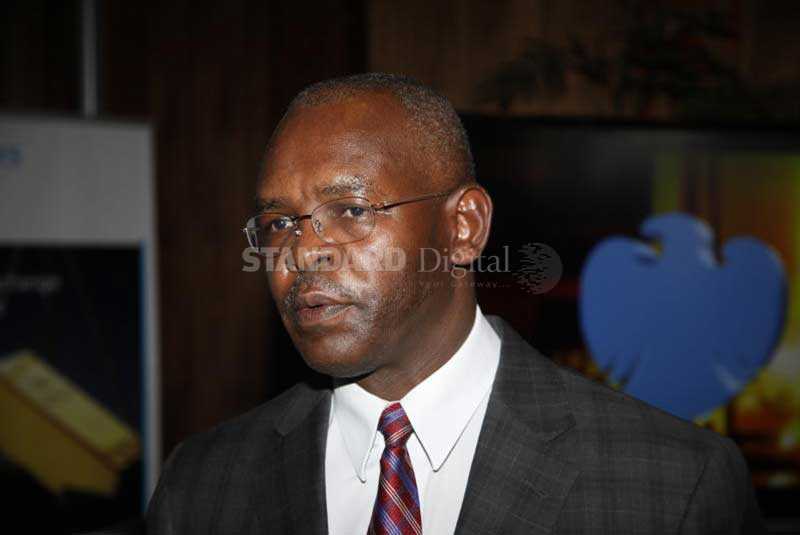

Principal Secretary Kamau Thugge said yesterday when the rate cap came into place in August 2016, credit to the private sector was already shrinking.